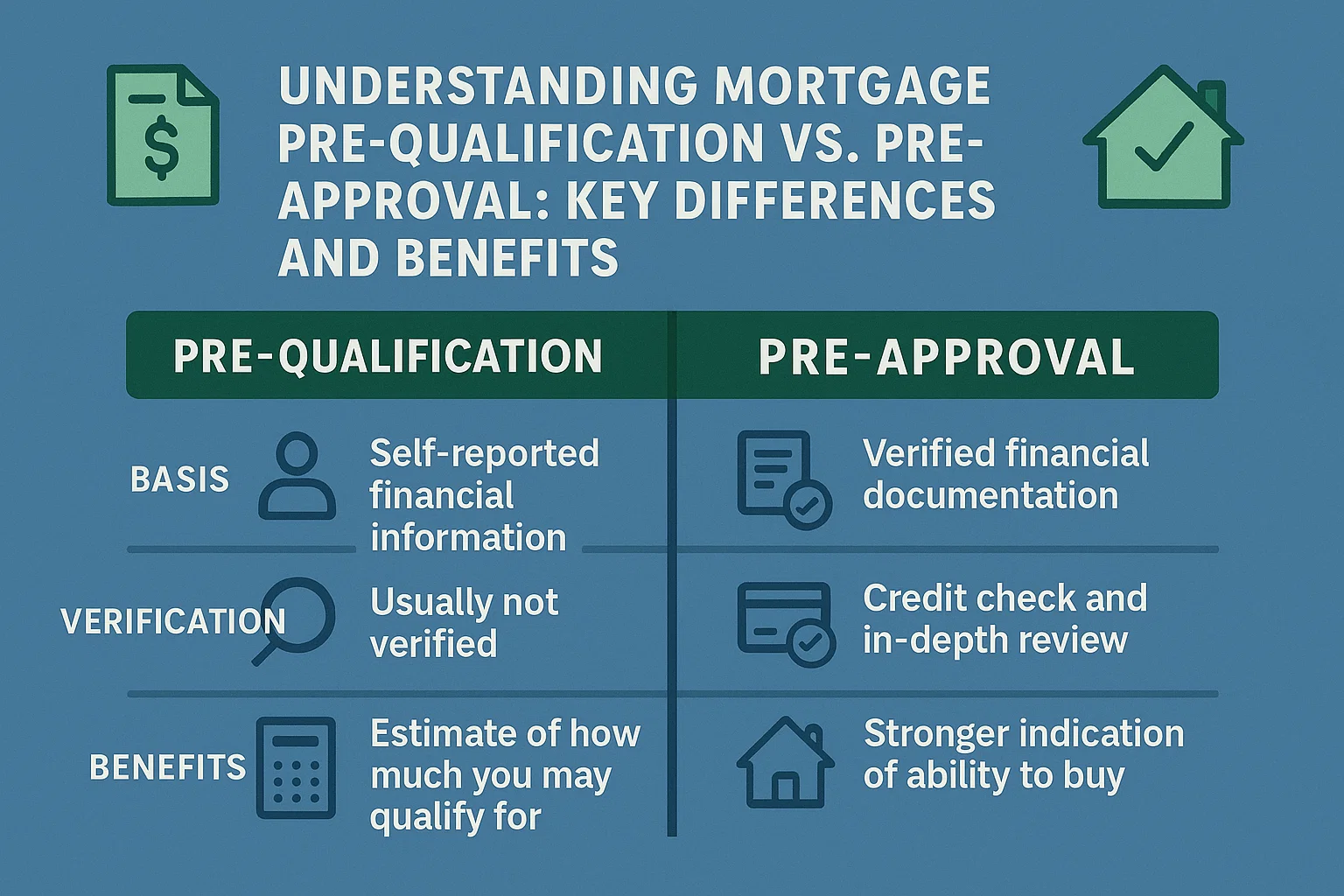

Understanding Mortgage Pre-Qualification vs. Pre-Approval: Key Differences and Benefits

Mortgage Pre-Qualification vs. Pre-Approval: What Homebuyers Need to Know

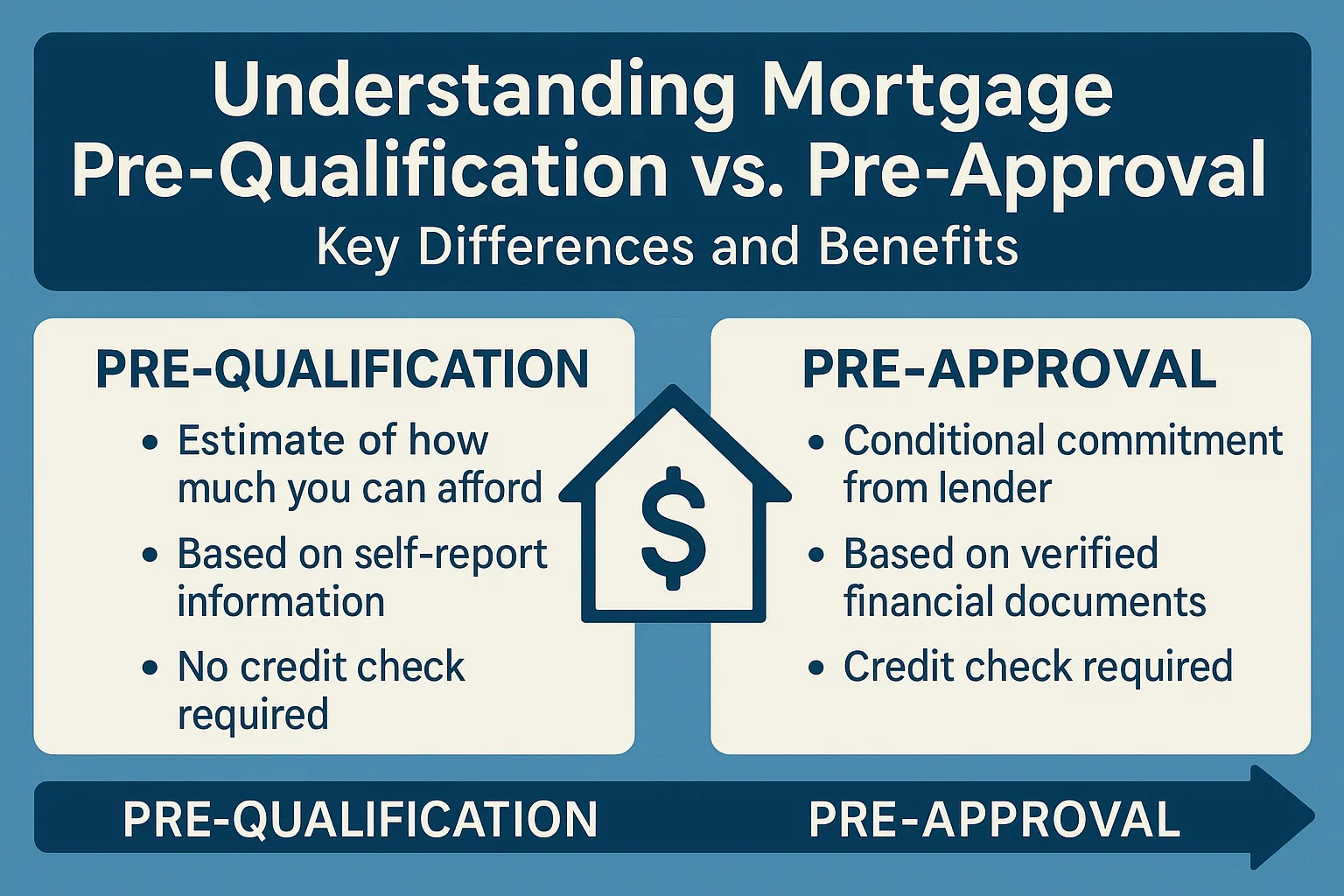

Navigating the mortgage process can be confusing, especially when terms like pre-qualification and pre-approval are used interchangeably. While both assess your eligibility for a home loan, they serve distinct purposes in preparing you for a successful home purchase. Here’s a breakdown of their differences and why they matter.

What Is Mortgage Pre-Qualification?

Pre-qualification is the initial step in the mortgage process. It provides a general estimate of how much you might borrow based on self-reported financial details. Here’s what to expect:

- Quick and Informal: Often completed online or via a brief phone call.

- Basic Financial Overview: You share income, debt, and asset information, which the lender uses for a preliminary credit check.

- No Verification: The estimate is not binding, as the lender does not verify your submitted data.

While pre-qualification helps set expectations, it does not guarantee loan approval.

What Is Mortgage Pre-Approval?

Pre-approval is a comprehensive evaluation of your financial health and creditworthiness. This step involves:

- Formal Application: Requires submitting a full mortgage application.

- Document Verification: The lender reviews pay stubs, tax returns, bank statements, credit reports, and other financial records.

- Conditional Commitment: You’ll receive a pre-approval letter stating the loan amount you qualify for, pending a home appraisal and stable finances.

A pre-approval strengthens your position as a serious buyer, giving sellers confidence in your ability to secure financing.

Why Pursue Pre-Qualification or Pre-Approval?

Benefits of Pre-Qualification

- Provides a starting point for your home search.

- Helps narrow down affordable price ranges.

Benefits of Pre-Approval

- Signals credibility to sellers in competitive markets.

- Accelerates the buying process once you find a home.

- Clarifies your exact budget, reducing time spent on unsuitable properties.

Final Thoughts

While neither pre-qualification nor pre-approval is mandatory, both tools empower buyers to make informed decisions. Pre-qualification offers a rough idea of your borrowing potential, while pre-approval solidifies your readiness to purchase. By understanding these steps, you can streamline your homebuying journey and act swiftly when the right opportunity arises.