Understanding Home Equity: A Comprehensive Guide for Homeowners

Understanding Home Equity: A Comprehensive Guide for Homeowners

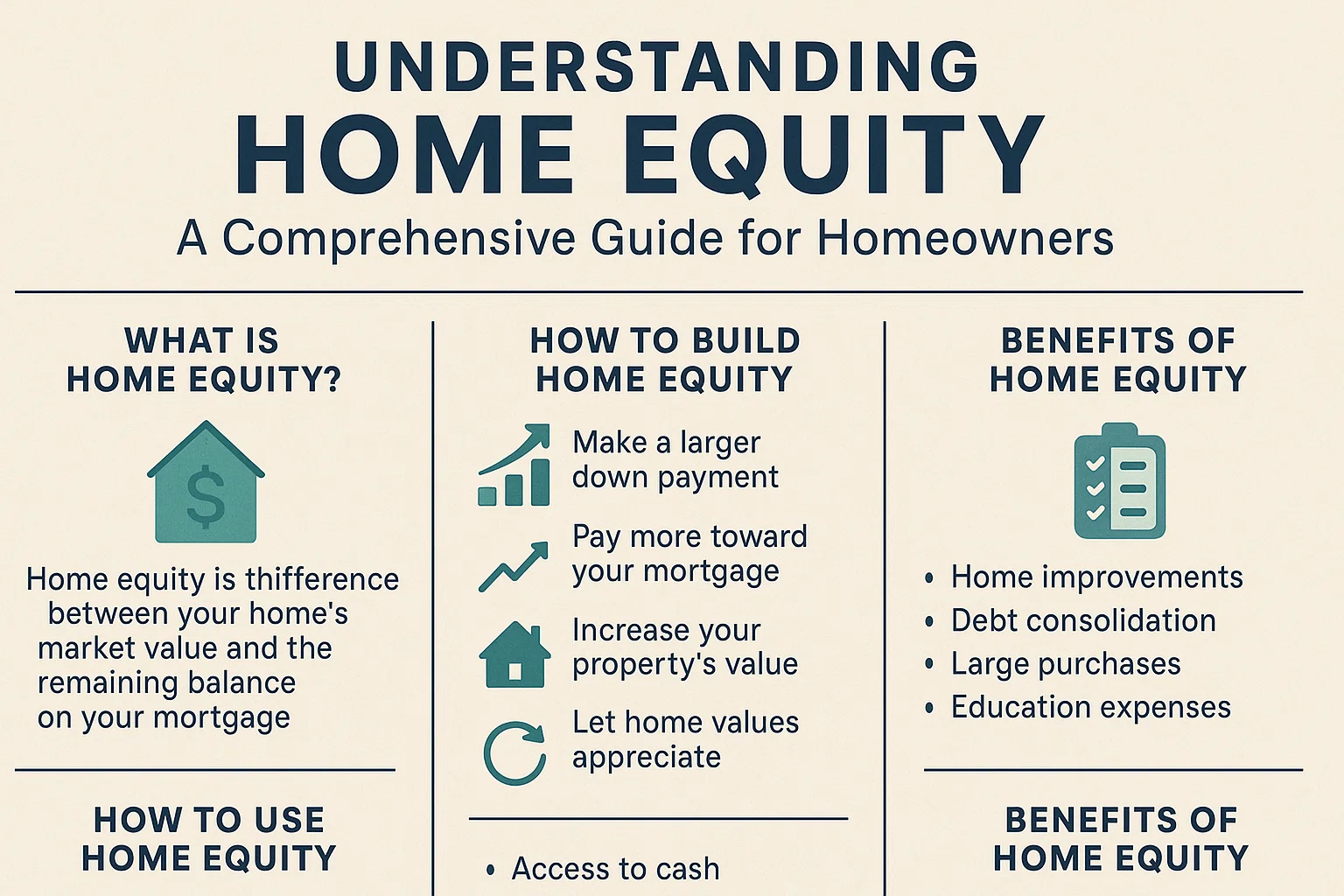

What Is Home Equity?

Home equity represents the portion of your home that you truly own. Think of it as your financial stake in your property. When you purchase a home with a mortgage, you gradually increase your ownership by paying down the loan. Over time, this builds your equity—essentially, the difference between your home’s market value and the remaining balance on your mortgage.

How to Calculate Home Equity

To determine your home equity:

Home Equity (Cash Value) = Home’s Market Value – Remaining Mortgage Balance

For example, if your home is worth $400,000 and you owe $280,000 on your mortgage:

$400,000 – $280,000 = $120,000 in equity

To calculate your equity as a percentage:

Equity Percentage = (Equity Cash Value ÷ Home’s Market Value) × 100

$120,000 ÷ $400,000 = 30% equity

How Home Equity Changes Over Time

Your equity grows through mortgage payments and home value appreciation. However, market downturns can reduce equity if your home’s value declines. For instance:

Equity Increase Example

If your home’s value rises to $440,000 and you still owe $280,000:

$440,000 – $280,000 = $160,000 in equity (36% of the home’s value).

Equity Decrease Example

If your home’s value drops to $360,000 with the same mortgage balance:

$360,000 – $280,000 = $80,000 in equity (22% of the home’s value).

Common Uses for Home Equity

- Eliminate PMI: Cancel private mortgage insurance once you reach 20% equity.

- Fund Home Improvements: Invest in renovations to boost your home’s value.

- Pay for Education: Use low-interest equity loans instead of high-rate student debt.

- Debt Consolidation: Combine high-interest debts into one manageable payment.

Borrowing Against Your Home Equity

Before borrowing, get a professional appraisal. Options include:

Home Equity Loan

A lump-sum loan with fixed interest rates, ideal for one-time expenses.

HELOC (Home Equity Line of Credit)

A revolving credit line with variable rates, suitable for ongoing needs.

Reverse Mortgage

For seniors 62+, this converts equity into cash without monthly payments.

Cash-Out Refinance

Replace your current mortgage with a larger loan and receive the difference in cash.

5 Tips to Build Home Equity Faster

- Make a Larger Down Payment: Start with a higher ownership stake.

- Pay More Toward Your Mortgage: Reduce principal faster with extra payments.

- Refinance to a Shorter-Term Loan: Save on interest and build equity quicker.

- Strategic Home Improvements: Focus on upgrades that boost market value.

- Stay in Your Home Longer: Benefit from long-term appreciation.

Why Home Equity Matters

Unlike renting, owning a home allows you to build wealth through equity. By understanding how to grow and leverage this asset, you can make smarter financial decisions and secure long-term stability.