The Essential Role of Loan Officers in Mortgage Acquisition

The Essential Role of Loan Officers in Mortgage Acquisition

Loan officers play a pivotal role in guiding prospective borrowers through the complex process of securing a home loan, also known as a mortgage. Their expertise extends far beyond basic application processing, as they act as advisors, evaluators, and facilitators throughout the lending journey.

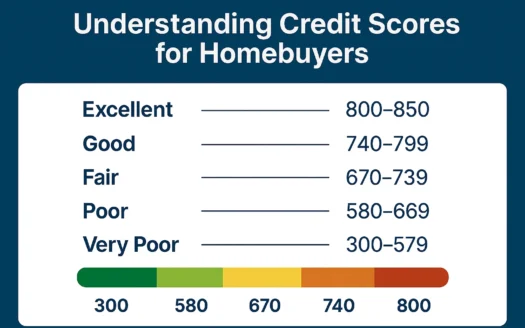

Understanding Creditworthiness

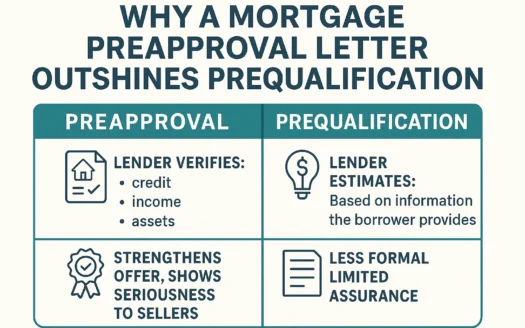

A core responsibility of loan officers is assessing a homebuyer’s creditworthiness—the likelihood that they will repay the loan. This involves analyzing financial history, income stability, and debt-to-income ratios to ensure borrowers meet lender requirements.

Navigating Loan Options

Modern mortgage markets offer a variety of loan types, each with unique terms and conditions. Loan officers provide clarity on options such as fixed-rate mortgages, adjustable-rate loans, FHA loans, and more. They help borrowers weigh the pros and cons of each product to align with individual financial goals and circumstances.

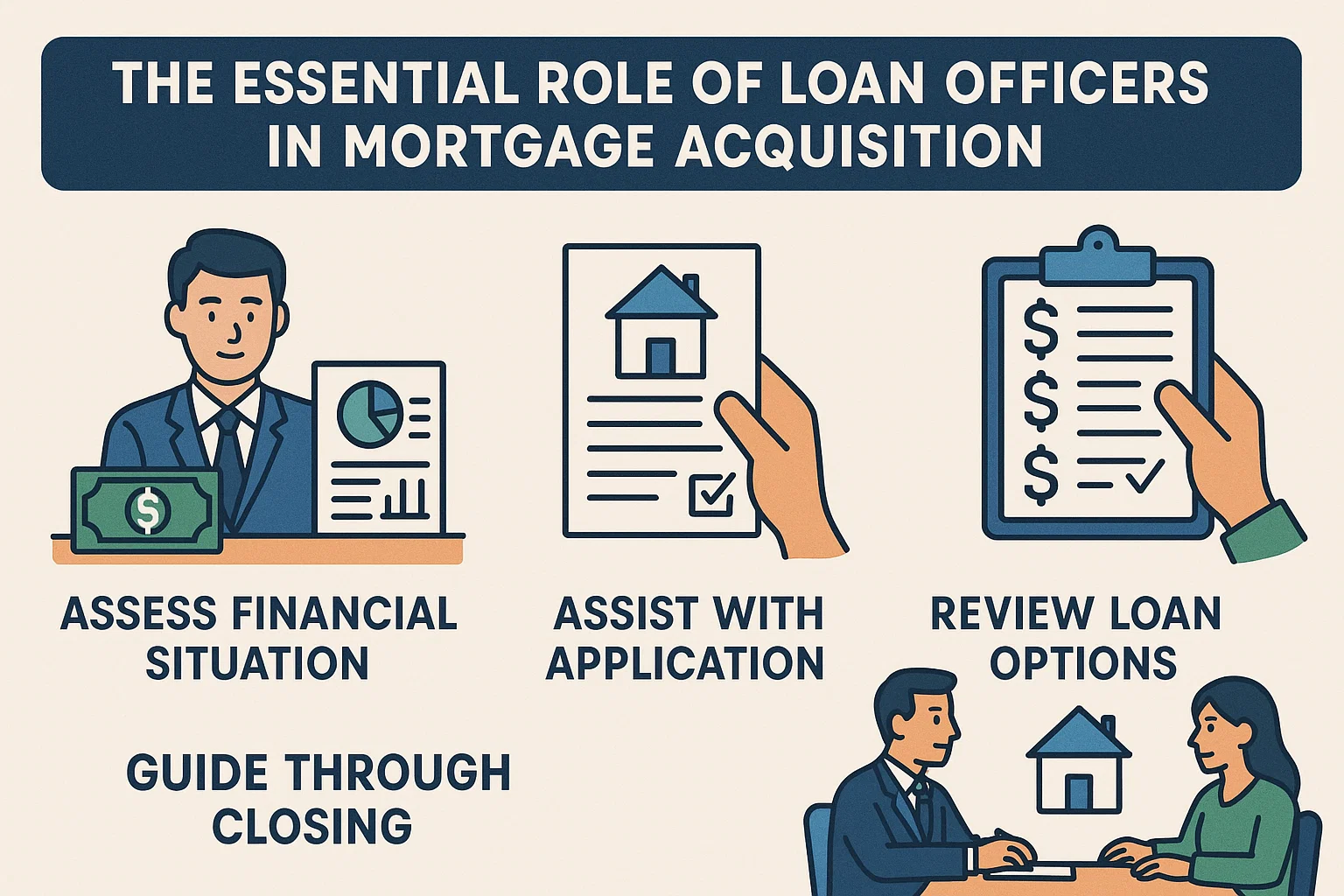

Streamlining the Mortgage Process

Once a borrower decides to apply, loan officers step in to:

- Outline required mortgage paperwork (e.g., tax returns, pay stubs, credit reports)

- Submit and track the application

- Coordinate with third parties (e.g., builders or real estate agents) to ensure timely closings

- Advise on interest rate locks to secure favorable terms

By managing these critical steps, loan officers minimize delays and simplify the path to homeownership. Their support ensures borrowers feel informed and confident at every stage.

Take the Next Step

Ready to explore your mortgage options? A loan officer can provide personalized guidance tailored to your financial situation.