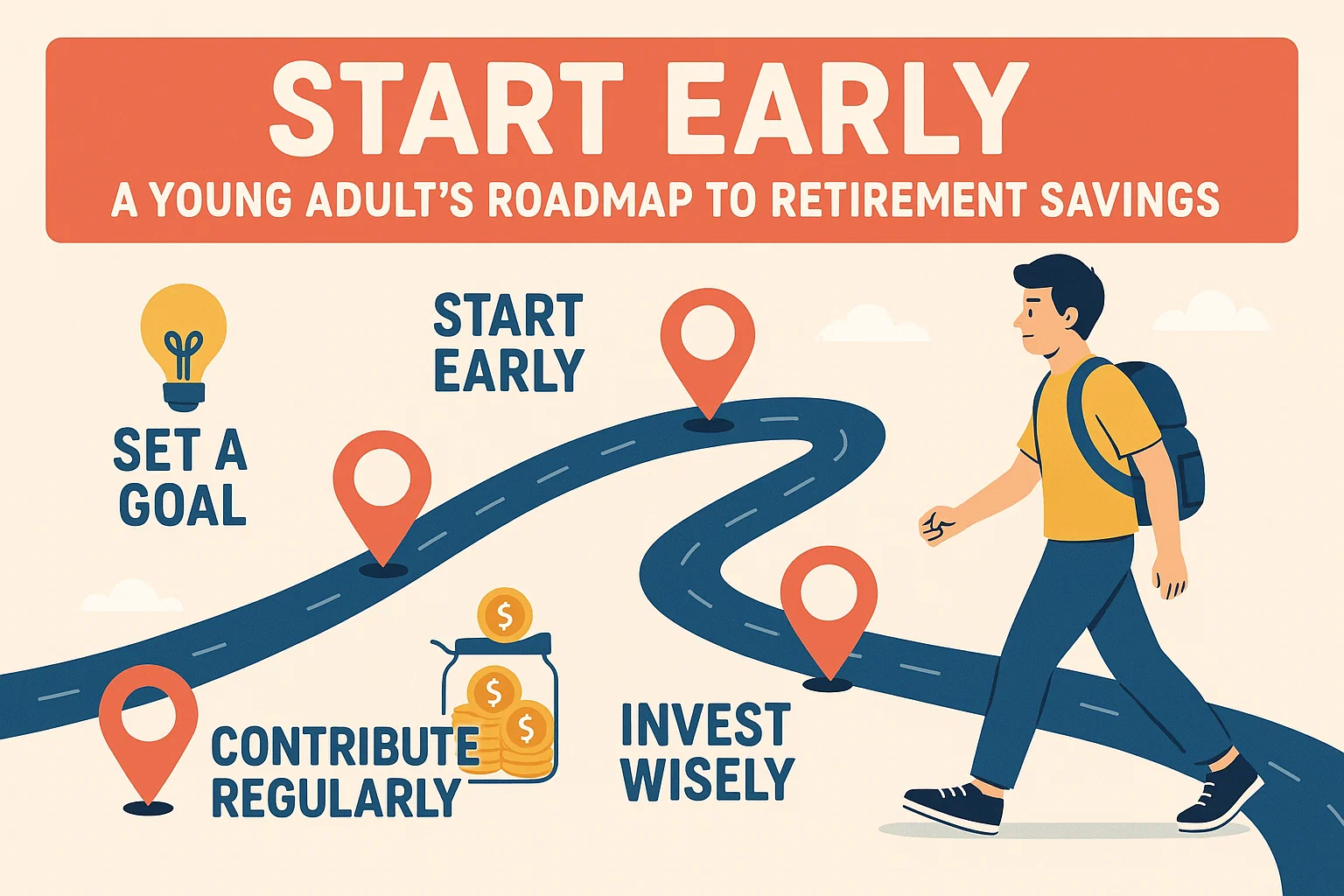

Start Early: A Young Adult’s Roadmap to Retirement Savings

Start Early: A Young Adult’s Roadmap to Retirement Savings

Retirement planning might seem low on your priority list as a young adult, especially when juggling student loans, rent, and daily expenses. However, prioritizing retirement savings early can unlock significant long-term advantages. Here’s how to lay the groundwork for a secure financial future.

Why Start Saving in Your 20s?

- Compound Interest: Early contributions grow exponentially over time.

- Tax Benefits: Reduce taxable income through retirement account contributions.

- Financial Discipline: Build habits that support lifelong financial health.

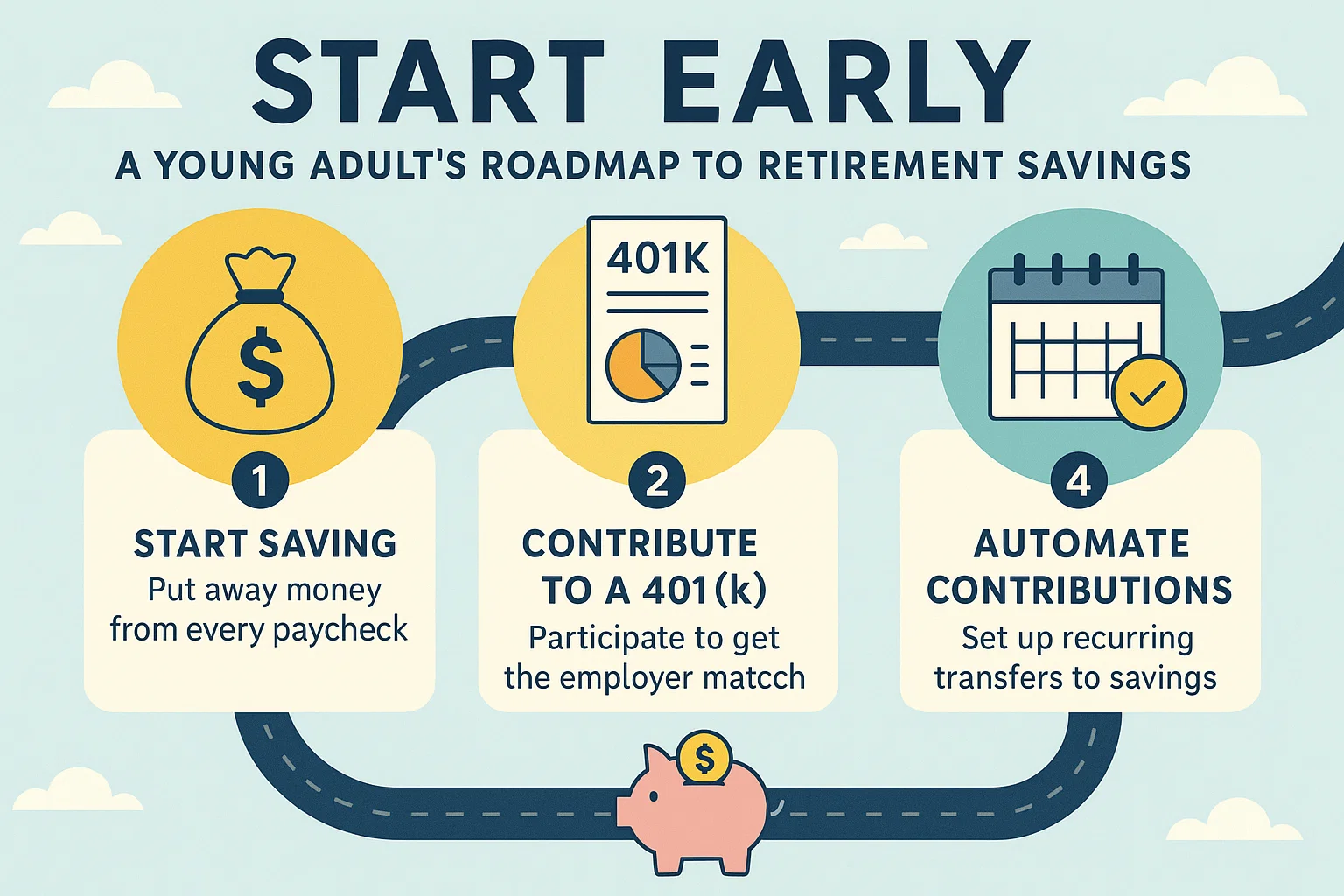

Practical Steps to Begin Today

1. Leverage Employer-Sponsored Plans

If your employer offers a 401(k), 403(b), or similar plan, enroll immediately. Contribute a portion of each paycheck, and aim to maximize any employer matching—it’s essentially free money.

2. Track and Optimize Spending

Categorize expenses using budgeting apps, spreadsheets, or journals to identify unnecessary spending. Redirect those funds toward retirement savings.

3. Balance Debt and Savings

Prioritize high-interest debt (like credit cards) while still contributing to retirement accounts. Automate payments to stay consistent with both goals.

4. Start Small, Think Big

Even modest contributions add up over time. Begin with a manageable amount and increase it as your income grows.

The Bottom Line

Building a retirement plan in your 20s requires discipline but pays off exponentially. By taking advantage of employer benefits, refining your budget, and balancing debt repayment with savings, you’ll create a sturdy foundation for the future. The key is to start now—your older self will thank you.