Maximize Your Savings: The Essential Guide to Bundling Insurance Policies

Unlock Savings by Bundling Your Insurance Policies

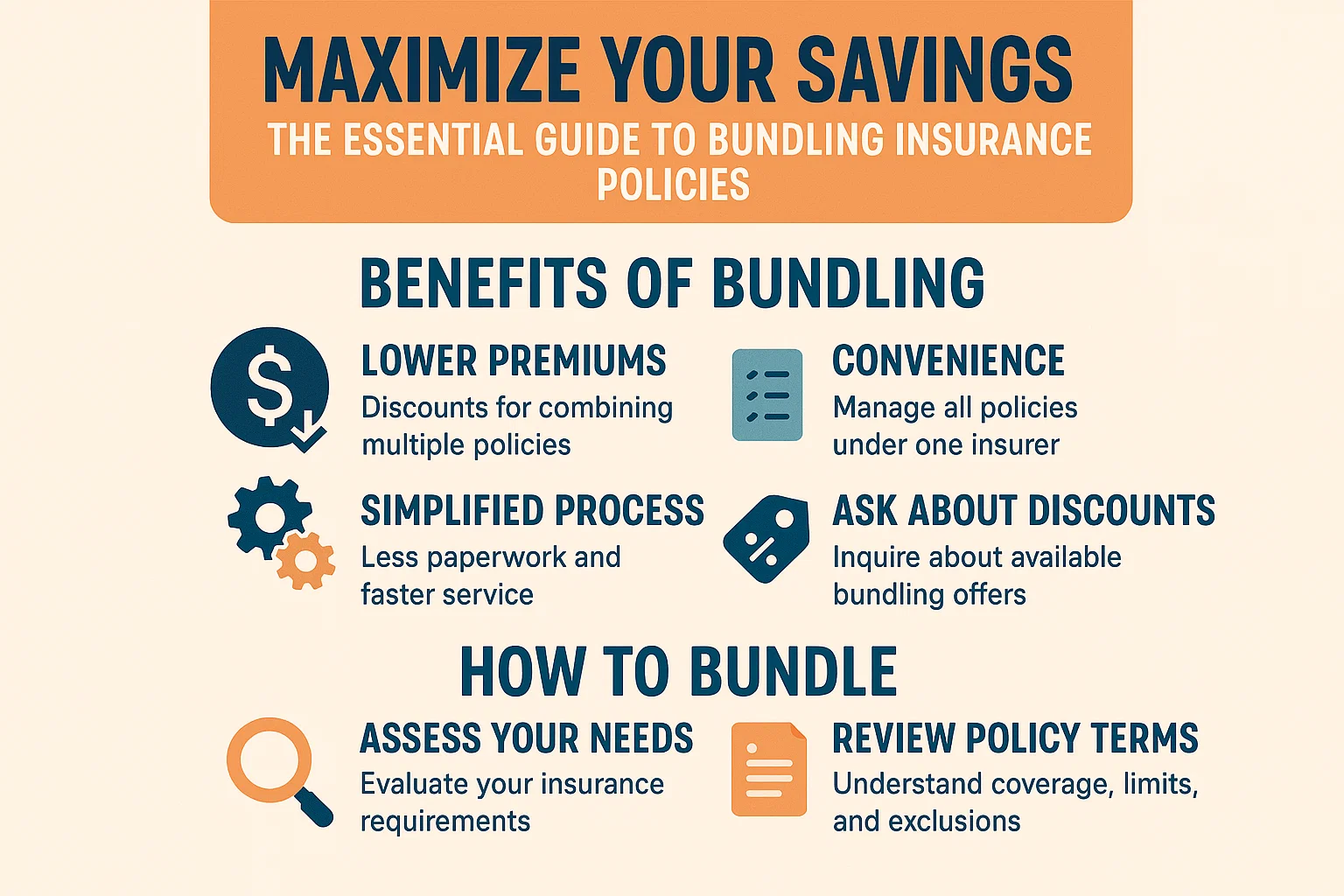

Insurance bundling—combining multiple policies like home, auto, and life insurance under one provider—is a proven way to reduce premiums. Just as bulk purchases often lead to discounts, bundling insurance can lead to significant savings. If you haven’t explored this option yet, here’s how to get started:

Step 1: Assess Your Current Insurance Costs

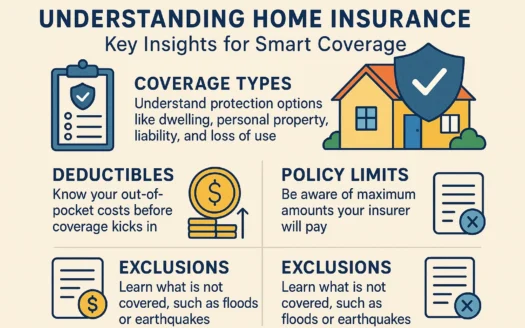

Begin by calculating your total spending on existing policies. This baseline will help you compare potential savings when bundling. Gather details about your coverage limits, deductibles, and premiums for an accurate comparison.

Step 2: Request Bundled Quotes

Contact insurance providers to request free quotes for bundled policies. Provide identical information about your coverage needs to each company to ensure quotes are comparable. Highlight that you’re seeking a multi-policy discount to unlock bundled rates.

Step 3: Evaluate and Choose the Best Option

Review the quotes carefully, ensuring coverage levels match your current policies. Even minor differences in deductibles or liability limits can impact costs. Select the bundle that offers the best value while maintaining the coverage you need.

Key Tips for Success:

- Confirm that bundled policies meet or exceed your current coverage.

- Ask about additional perks, like waived fees or loyalty rewards.

- Re-evaluate your bundle annually to adapt to changing needs.

By consolidating your insurance policies, you streamline payments and often gain access to exclusive discounts. Start exploring bundled options today to see how much you could save!