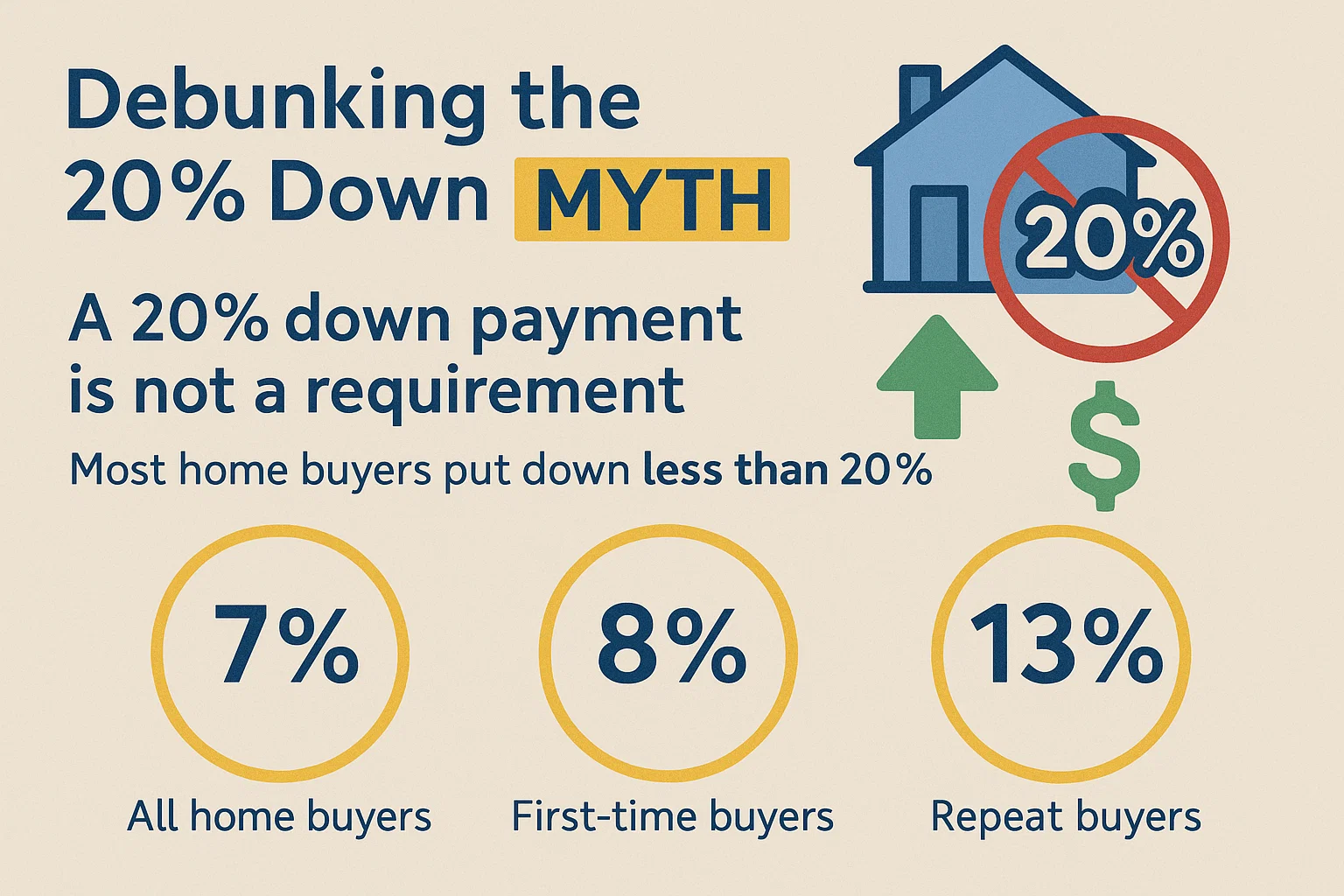

Debunking the 20% Down Payment Myth

Debunking the 20% Down Payment Myth: How to Buy a Home with Less

The idea that you need a 20% down payment to buy a home is a myth. Many homeowners qualify for mortgages with little to no money down, and there are multiple strategies to avoid costly mortgage insurance (PMI) without hitting that 20% threshold. Here’s how it works:

Why the 20% Myth Persists

The primary reason people recommend a 20% down payment is to avoid private mortgage insurance (PMI). However, there are alternatives to eliminate PMI even with a smaller down payment.

Key Strategies to Avoid PMI

- Conventional Loans: PMI can often be removed after just 12 months of on-time payments, provided your home’s value meets certain criteria.

- Piggyback Mortgages: Use a second loan to cover part of the down payment, bypassing PMI requirements.

- VA Loans: Eligible veterans and service members can secure loans with $0 down and no PMI.

- Refinance Later: Once you reach 20% equity, refinancing can remove PMI.

Minimum Down Payment Requirements

Each loan type has its own minimum down payment, which is typically far below 20%:

- Conventional loans: As low as 3%

- FHA loans: 3.5%

- VA/USDA loans: 0% (for eligible borrowers)

Important Notes

- Borrowers with a credit score below 620 may need to complete a pre-closing homebuyer education course.

- Requirements and policies can vary by lender and loan program.

The Bottom Line

Fact: Many current homeowners purchased their properties with less than 20% down. With the right approach, you can minimize upfront costs while still securing an affordable mortgage.

Note: Always consult a financial advisor or mortgage professional to explore the best options for your situation.