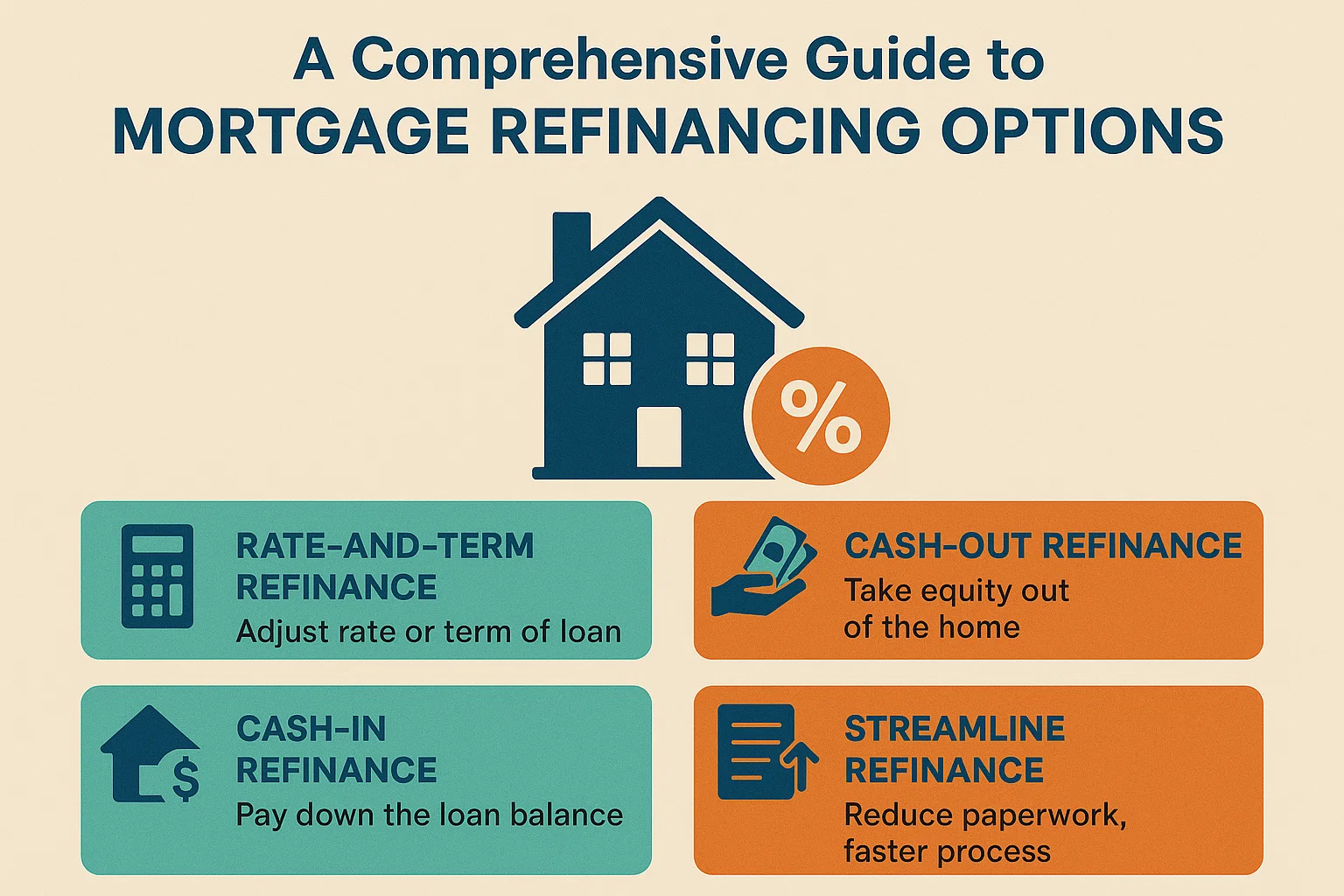

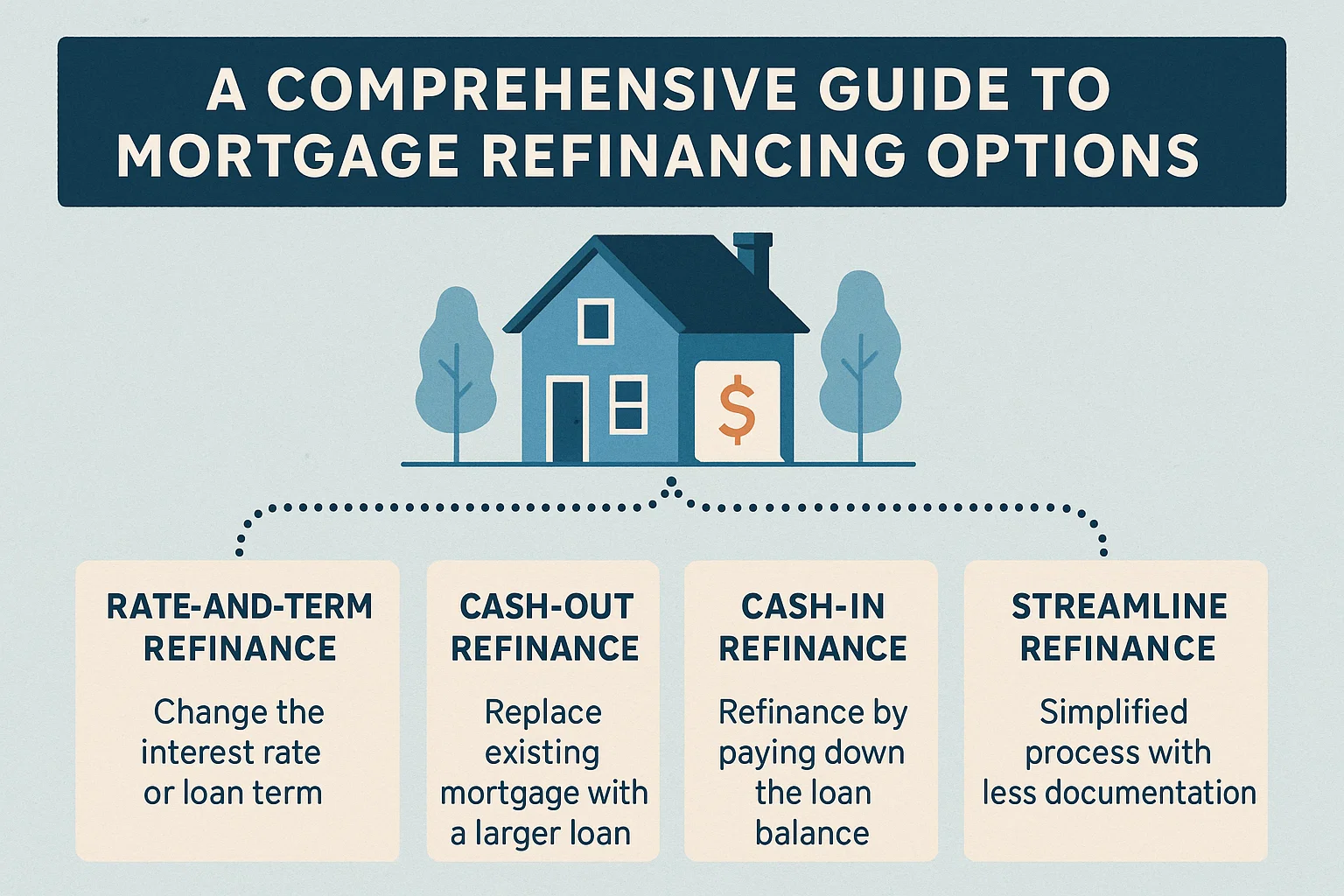

A Comprehensive Guide to Mortgage Refinancing Options

A Comprehensive Guide to Mortgage Refinancing Options

1. Rate-and-Term Refinance

This option replaces your existing loan with a new one, using your current home as collateral. It can lower your interest rate or adjust your loan term for more affordable payments.

When to Choose a Fixed-Rate Mortgage

- You want to lock in low-interest rates

- You prefer consistent monthly payments

When to Choose an Adjustable-Rate Mortgage (ARM)

- You have an existing ARM with interest rates predicted to rise

- Your current fixed-rate mortgage has a high-interest rate

- You plan to sell or move before the initial rate period ends

- You’re comfortable with potential rate fluctuations

When to Choose a 15-Year Refinance

- You prefer a shorter payoff timeline and lower interest rates (with higher monthly payments)

When to Choose a 30-Year Refinance

- You want a fixed interest rate without increasing your monthly payment

2. Cash-Out Refinance

This replaces your existing mortgage with a larger loan, providing extra funds after paying off the original balance. Ideal for accessing equity for major expenses.

When to Consider Cash-Out Refinancing

- Your home’s value exceeds your current mortgage balance

- You want to consolidate high-interest debt

- You need funds for home improvements or education costs

3. Cash-In Refinance

This requires bringing funds to closing to reduce your loan balance. Helps homeowners who owe more than their home’s value or want to avoid costly loan terms.

When to Consider Cash-In Refinancing

- You aim to eliminate mortgage insurance or qualify for better loan terms

- You want to avoid jumbo loan rates

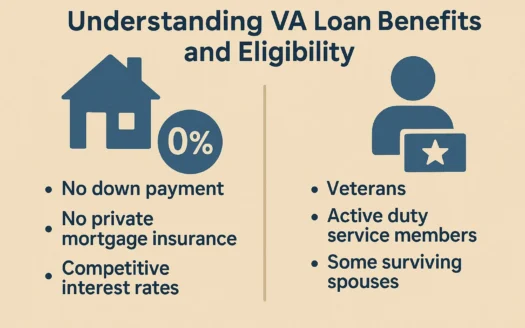

4. Government-Backed Refinance

Programs like HARP or FHA refinancing assist homeowners with unique eligibility requirements, such as refinancing underwater mortgages or federal loan guarantees.

When to Consider Government Refinancing

- You have an FHA, VA, or other government-backed mortgage

- Your home’s value is significantly below your loan balance

Got questions? Consult a mortgage professional to explore your best refinancing path!