Understanding Property Tax Assessments: A Homeowner’s Guide

Understanding Property Tax Assessments: A Homeowner’s Guide

Each year, homeowners receive a property tax bill—a necessary expense that funds critical public services like schools, roads, and emergency response teams. While not always welcome, these taxes play a vital role in community infrastructure. The amount you owe hinges on your property tax assessment, a process that evaluates your property’s value. Let’s break down how assessments work and what you need to know.

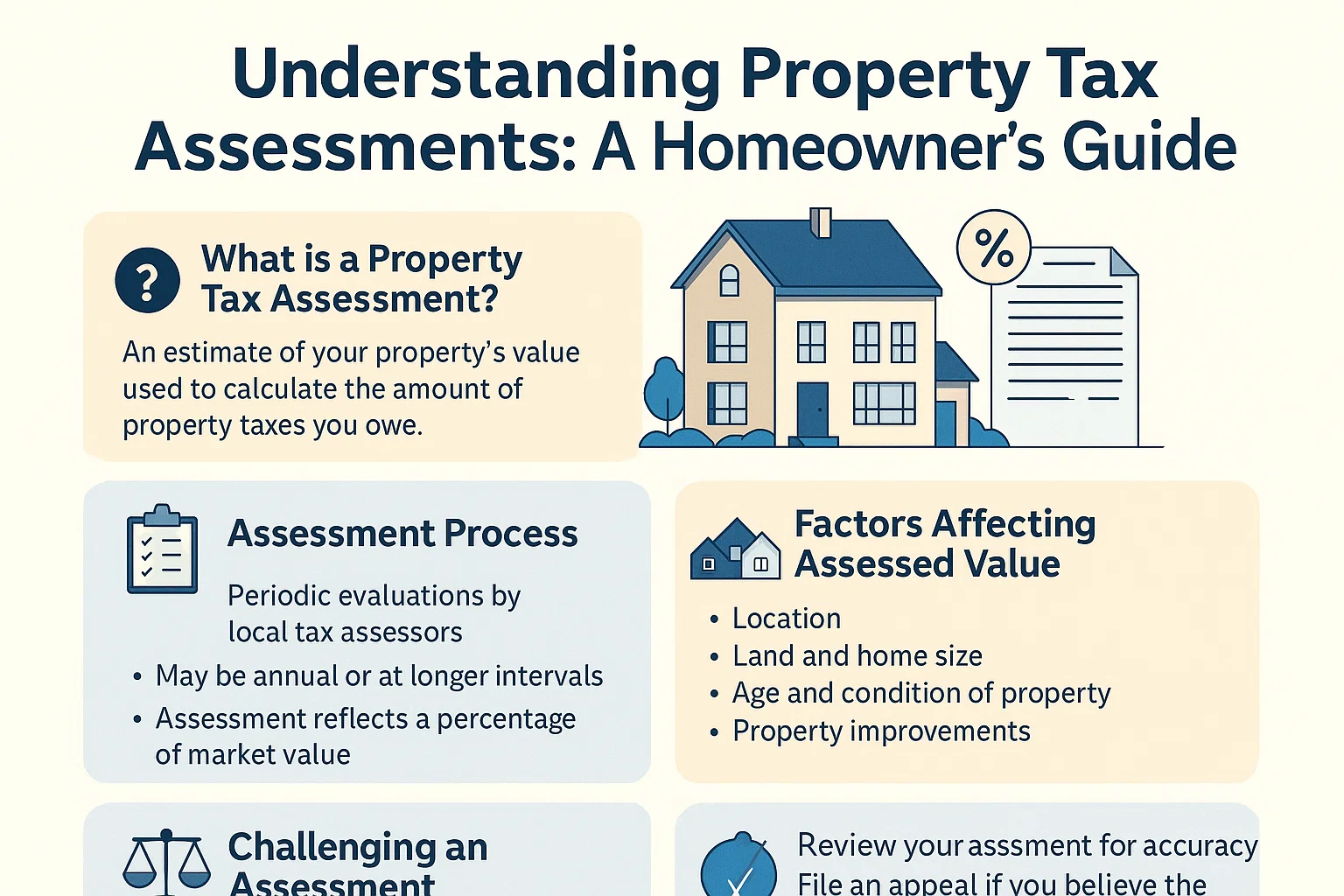

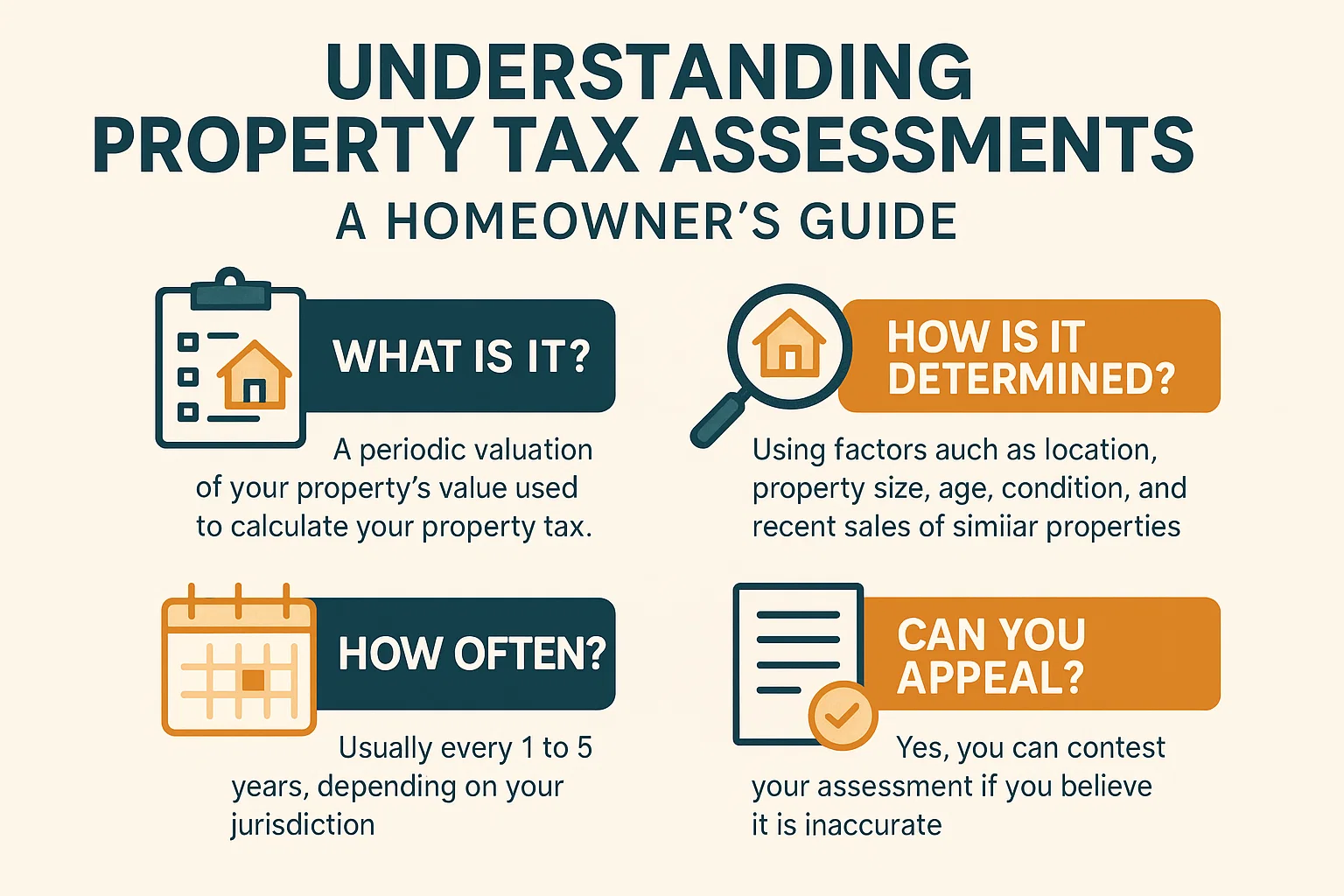

How Property Tax Assessments Work

Property tax rules vary by state and county, but assessments typically follow these steps:

- Annual Payments: Taxes are usually due yearly.

- Valuation Cycles: Assessors evaluate properties every 1–5 years.

- Key Factors: Assessors review local home sales, market trends, and municipal budgets to determine tax rates.

Property Taxes vs. Tax Assessments

A tax assessment determines your property’s value and the corresponding tax obligation. Regardless of your home type (single-family, condo, etc.), taxes apply universally based on this valuation.

What Factors Influence a Tax Assessment?

Assessors evaluate multiple criteria, including:

- Property size and layout

- Construction materials and age

- Location and neighborhood trends

3 Methods Used for Property Tax Assessments

1. The Cost Method

This approach estimates the cost to rebuild your property from scratch. Assessors factor in labor, materials, land value, and depreciation.

2. The Sales Comparison Method

Your property’s value is compared to similar recently sold homes. Adjustments are made for unique features (e.g., upgrades, lot size).

3. The Income Method

Primarily for commercial properties, this method analyzes potential income after expenses like maintenance, insurance, and taxes.

Paying Property Taxes: What to Expect

Even after paying off your mortgage, property taxes remain a lifelong responsibility. You’ll receive a separate bill directly from your local government.

Common Tax Exemptions

Many jurisdictions offer exemptions to reduce your tax burden, such as:

- Homestead Exemption: For primary residences.

- Senior Exemption: For retirees.

- Veteran Exemption: For military veterans.

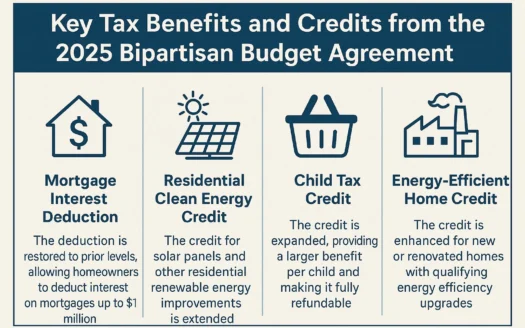

Tax Deductions: Federal vs. Standard

Homeowners can deduct property taxes by itemizing federal tax returns. This is beneficial if itemized deductions (including mortgage interest and charitable contributions) exceed the standard deduction for your filing status.

How to Dispute a Tax Assessment

If you believe your assessment is inaccurate, you can appeal. Contact your local tax office to request a reassessment and submit supporting documents (e.g., recent appraisals or repair estimates).

Final Thoughts

Property taxes are unavoidable, but understanding how they’re calculated empowers you to manage costs effectively. For personalized guidance, consult local tax professionals or real estate experts.