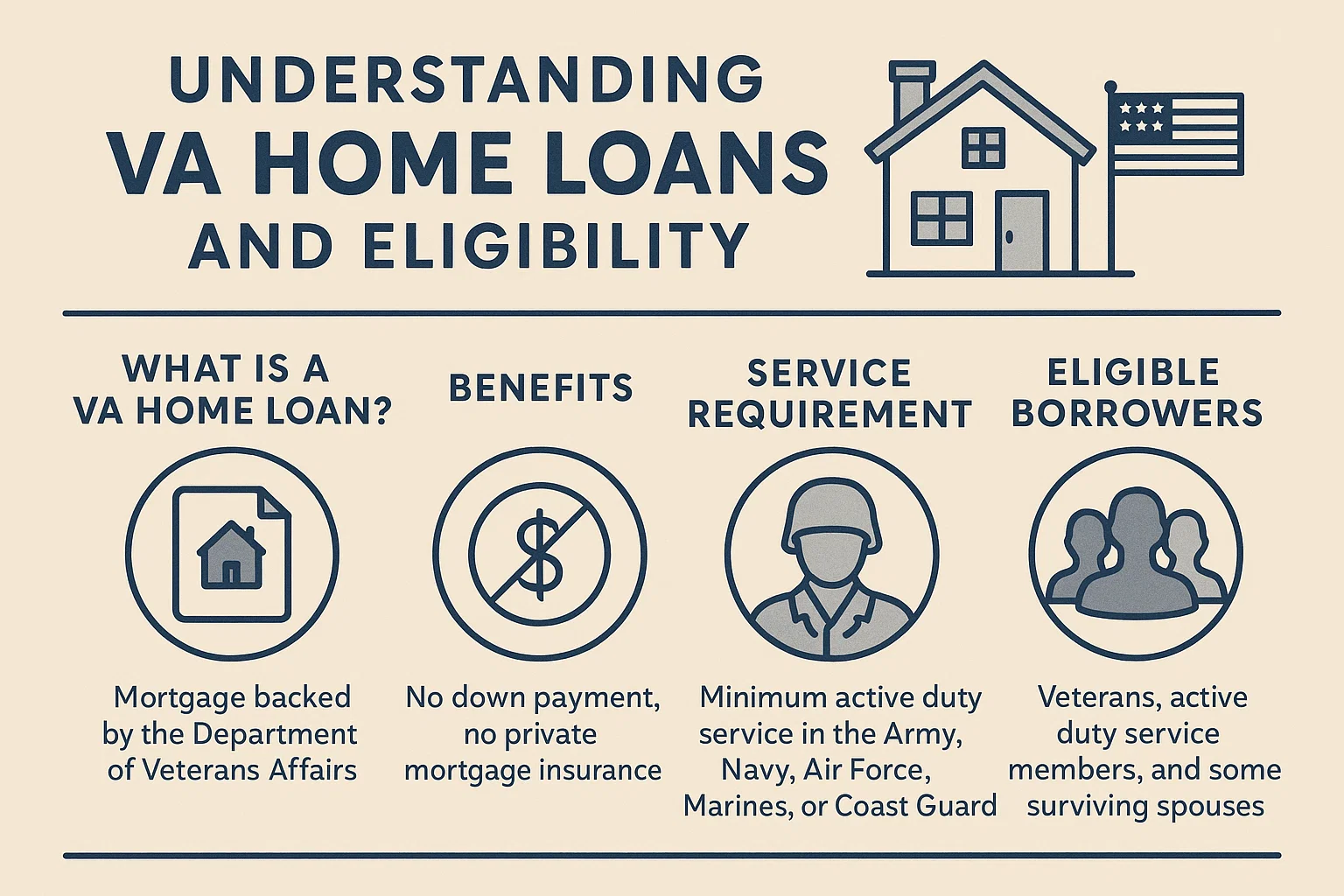

Understanding VA Home Loans and Eligibility

Understanding VA Home Loans: Benefits and Eligibility Criteria

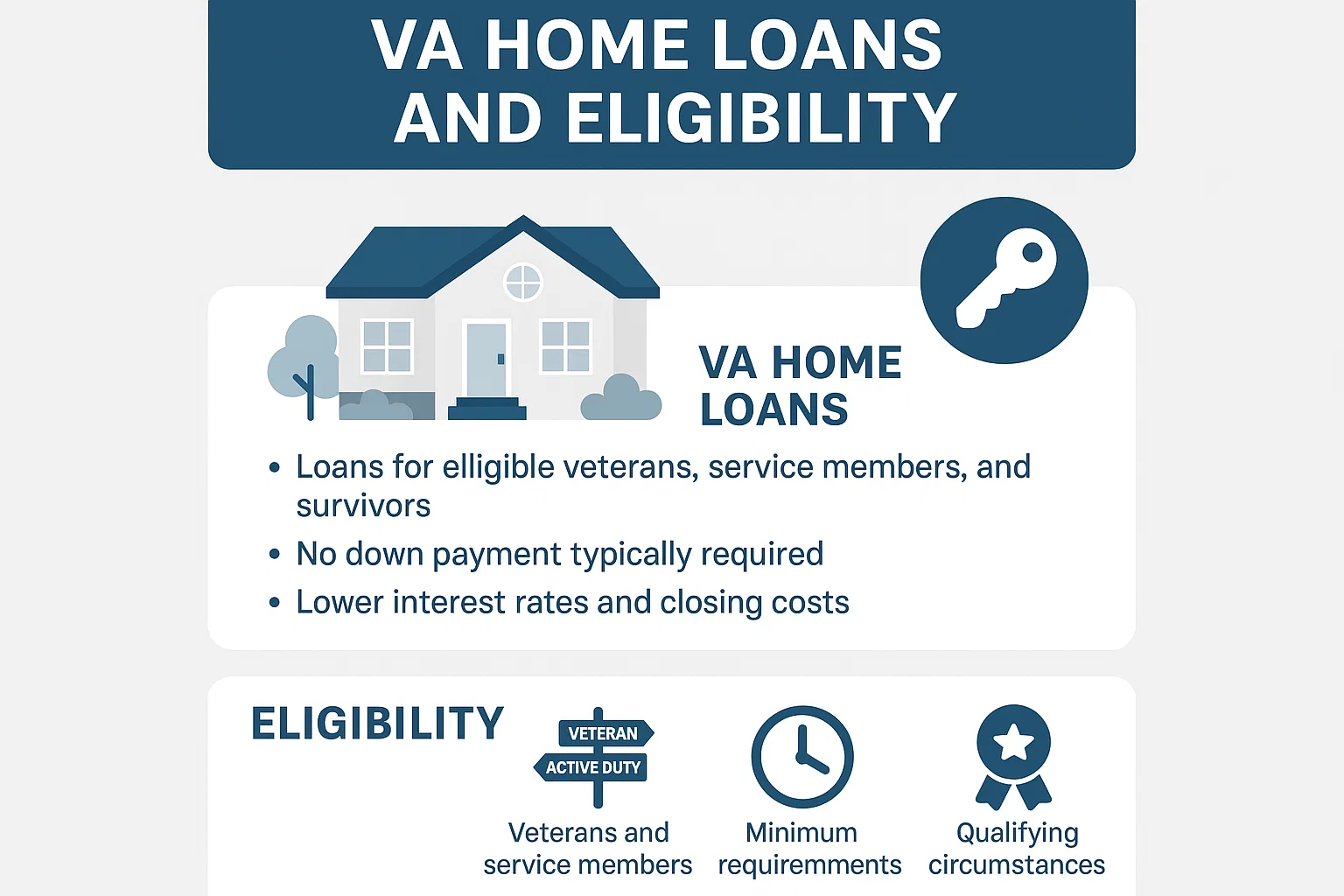

A VA home loan is a mortgage program backed by the U.S. Department of Veterans Affairs (VA), specifically tailored to assist active-duty service members, veterans, and eligible military families in purchasing, refinancing, or renovating a home. This program reduces financial barriers by offering competitive terms and rates compared to conventional mortgages.

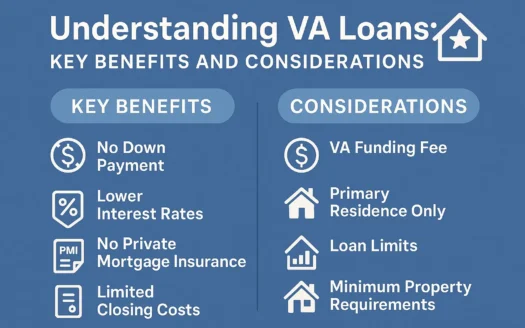

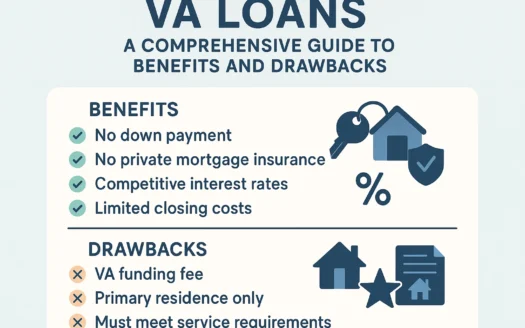

Key Benefits of VA Home Loans

- Government-backed security: VA loans are partially guaranteed by the federal government, lowering lender risk.

- Competitive interest rates: Borrowers often secure lower rates than those available for traditional loans.

- No down payment required: Most VA loans eliminate the need for a down payment, easing upfront costs.

- Flexible credit requirements: The program accommodates a broader range of credit profiles.

Who Qualifies for a VA Loan?

Eligibility is primarily extended to:

- Active-duty military personnel

- Veterans who meet service duration requirements

- Members of the National Guard or Reserves

- Qualifying surviving spouses of deceased service members

Important: Applicants must provide a Certificate of Eligibility (COE) and meet specific service criteria. Additional documentation, such as discharge papers or service records, may be required.

Additional Considerations

While VA loans offer significant advantages, terms may vary based on lender policies and individual financial circumstances. Borrowers should compare offers and consult VA-approved lenders to explore personalized options.