5 Essential Steps to Determine Your Affordable Mortgage

5 Essential Steps to Determine Your Affordable Mortgage

The journey to homeownership is exciting, but understanding your financial limits is critical. Instead of asking, “How much can I borrow?”, focus on “How much should I spend?”. Follow these steps to gauge your mortgage affordability and secure a stress-free homebuying experience.

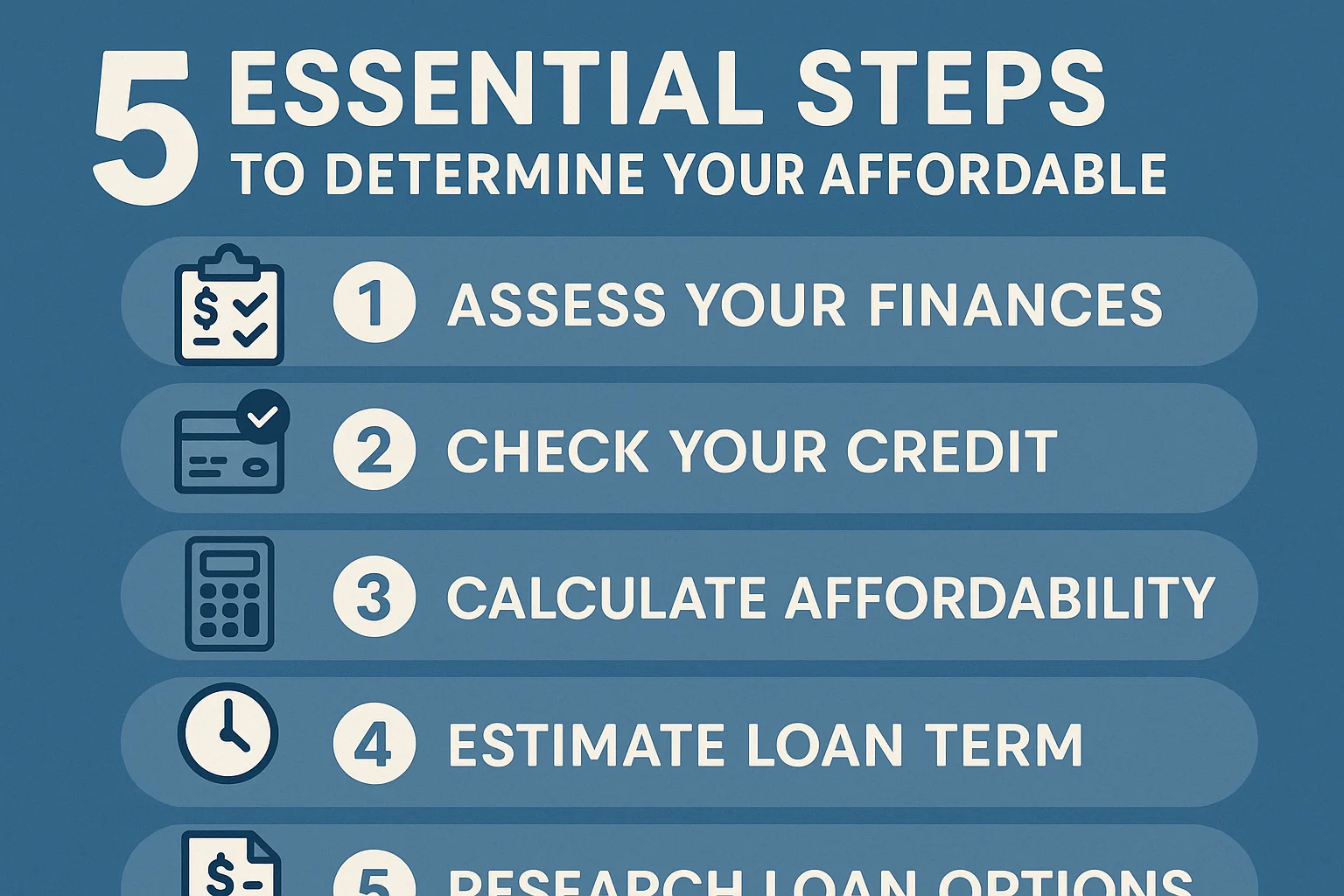

1. Analyze Your Income Streams

Gross Income: Calculate your total earnings, including salary, self-employment income, Social Security benefits, and alimony. Most lenders recommend keeping housing costs below 28% of your gross income.

Net Income: Subtract taxes and deductions from your gross income. This reflects your actual take-home pay. If your dream home’s mortgage would consume most of your net income, consider scaling back.

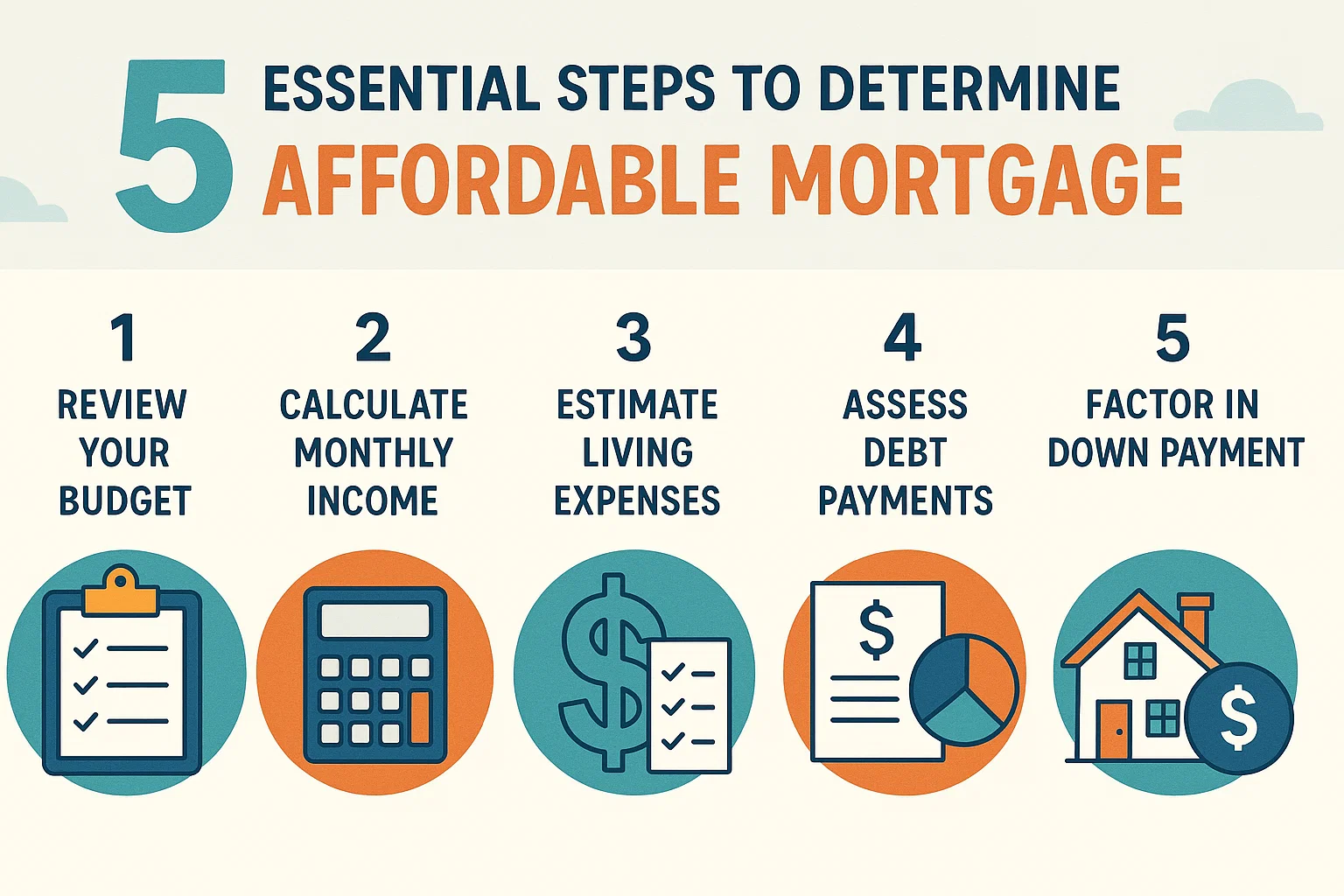

2. Track Expenses and Debt

List all monthly expenses—entertainment, clothing, subscriptions, etc.—and identify areas to cut back. Next, calculate your debt-to-income (DTI) ratio:

- Add monthly debt payments (loans, credit cards, etc.).

- Divide by your gross monthly income.

- Aim for a DTI below 36% to qualify for better loan terms.

3. Review Your Credit Health

Check your credit report annually at AnnualCreditReport.com to spot errors or unresolved debts. A low credit score may lead to higher interest rates. Dispute inaccuracies promptly to protect your financial standing.

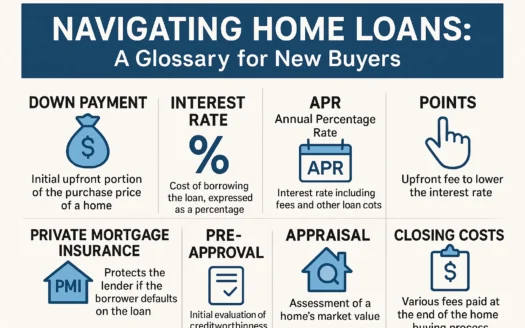

4. Plan Your Down Payment Strategy

While 20% down payments are ideal, some loans require as little as 3.5%. Use a mortgage calculator to see how a larger down payment reduces monthly costs. Remember: bigger upfront payments lower long-term expenses.

5. Factor in Hidden Homeownership Costs

Beyond the mortgage, budget for:

- Property taxes (varies by state)

- Homeowners insurance (mandatory for most loans)

- Utilities (electricity, water, internet)

- HOA fees (for shared amenities/services)

- Closing costs (2%-5% of the home price)

Next Steps: Pre-Qualify and House Hunt

Get pre-qualified with a lender to refine your budget. Gather these documents to streamline the process:

- Recent 30-day pay stub

- Two months of bank/retirement account statements

- Two years of W-2s and employment history

- Rental payment records (if applicable)

With a clear budget and pre-qualification letter, you’re ready to confidently search for your new home!