The Essential Guide to Mortgage Pre-Qualification for Homebuyers

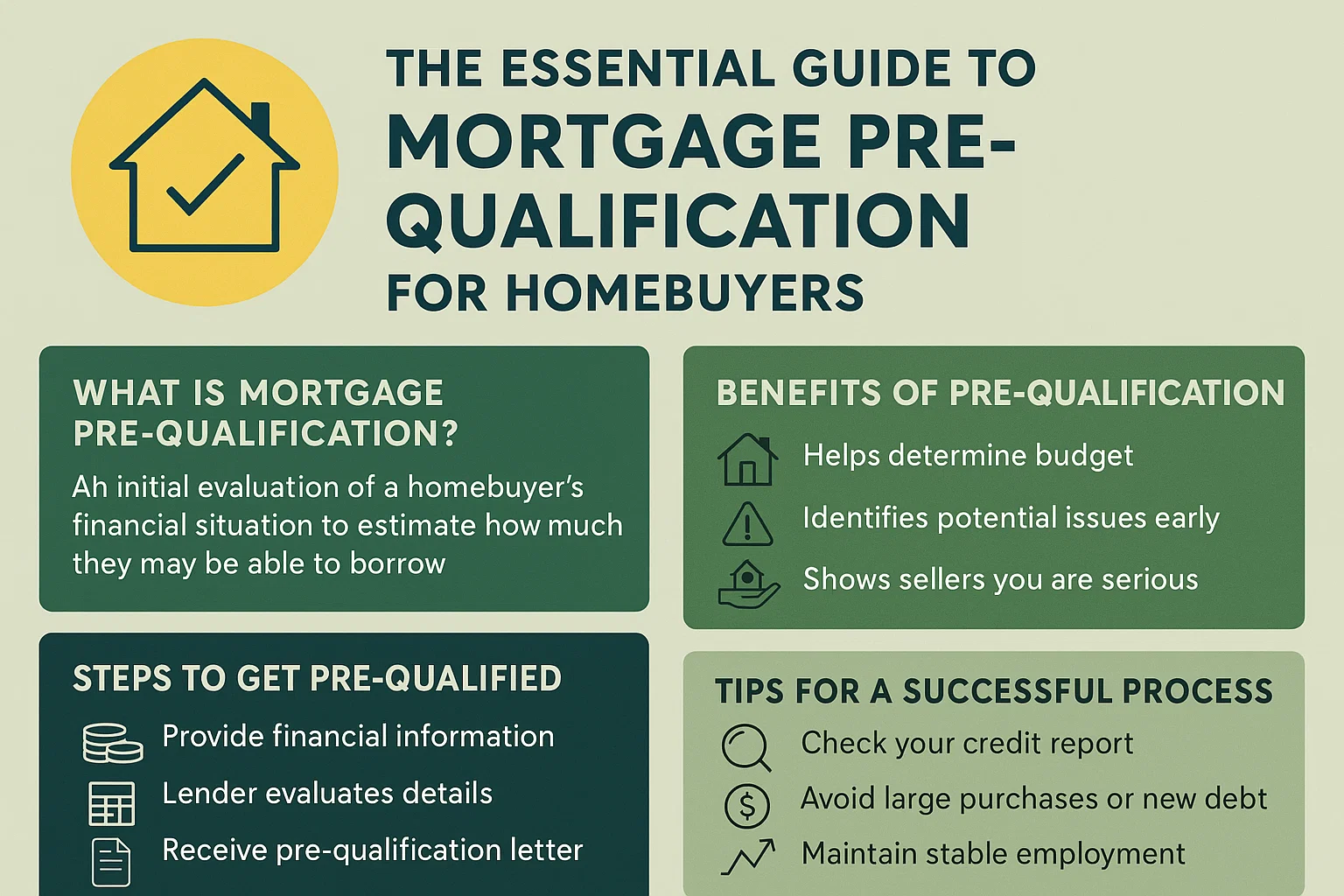

Why Mortgage Pre-Qalification Should Be Your First Step in Homebuying

Don’t Let Homebuying Disappointments Derail Your Dreams

With decades of experience in the housing industry, we’ve witnessed countless buyers face avoidable setbacks. From falling in love with unaffordable floor plans to losing prime lots to pre-qualified competitors, the pitfalls are real. Before diving into neighborhood research or scrolling through listings, take this critical step: pre-qualify for a mortgage.

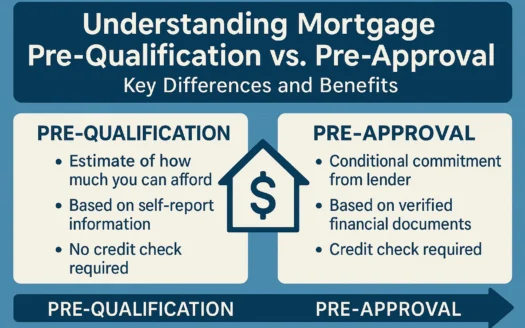

Pre-Qualification vs. Pre-Approval: What’s the Difference?

While some lenders use these terms interchangeably, here’s the general distinction:

- Pre-Qualification: A quick estimate of borrowing potential based on self-reported financial details. No documentation or credit check required.

- Pre-Approval: A more rigorous process involving credit verification and financial documentation.

Note: Final loan approval depends on property-specific factors, so neither pre-qualification nor pre-approval guarantees funding.

6 Key Benefits of Mortgage Pre-Qualification

1. Define Your Realistic Price Range

Monthly housing costs involve more than just the home price. Property taxes, interest rates, and down payments all play a role. Pre-qualification provides a ballpark figure to narrow your search to neighborhoods and floor plans within your budget.

2. Save Time and Energy

Avoid wasting hours touring homes you can’t afford. Use price filters on homebuying websites to focus on properties that align with your pre-qualified range.

3. Accelerate the Approval Process

With preliminary financial groundwork completed, pre-qualified buyers often experience faster mortgage processing—a crucial advantage in competitive markets.

4. Gain a Competitive Edge

In bidding wars or fast-selling communities, pre-qualification signals seriousness to sellers and may secure priority access to desirable lots or pricing.

5. Clarify Your Loan Preferences

The process helps refine your needs: fixed vs. adjustable rates, loan terms (15-year, 30-year), and loan types. This knowledge empowers you to choose lenders aligned with your goals.

6. Budget Beyond the Mortgage

Understanding your borrowing limit lets you plan for hidden costs like utilities, furnishings, and maintenance—especially valuable for first-time buyers.

Take Control of Your Home Search

Mortgage pre-qualification isn’t mandatory, but it transforms your homebuying journey from stressful to strategic. By clarifying your financial position upfront, you’ll shop confidently, act decisively, and focus on what matters most: finding the perfect home.

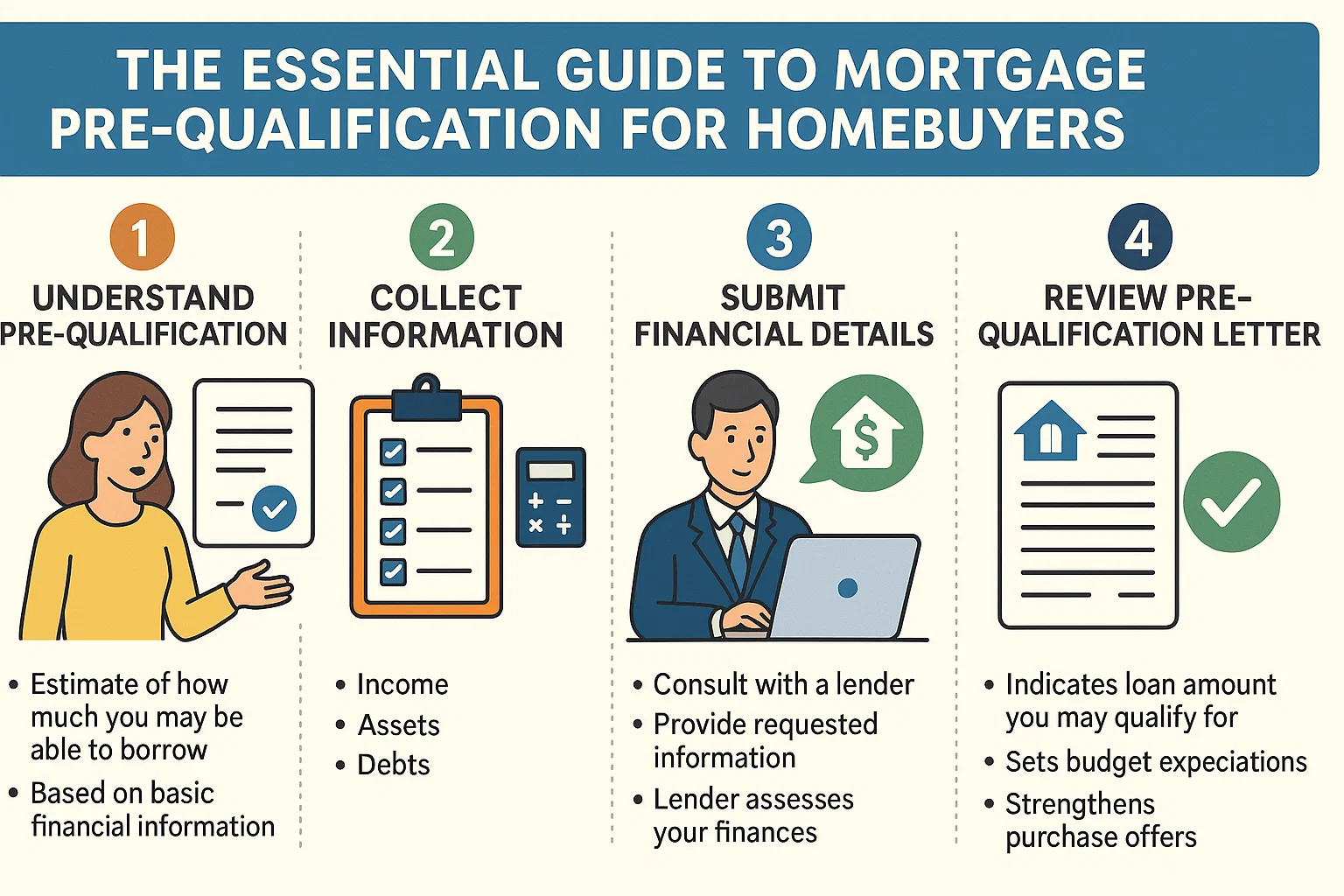

How to Get Started

Consult a loan officer to explore options and loan programs. Many lenders offer online applications for quick pre-qualification estimates.