Get Pre-Approved for your New Home Mortgage

With ____ you can instantly get your credit scores from all 3 major credit bureaus! Select the ‘Get my free score!’ button below to get started.

🏡 Get Pre-Approved for Your New Home Mortgage

Your First Step Toward Buying a New Construction Home

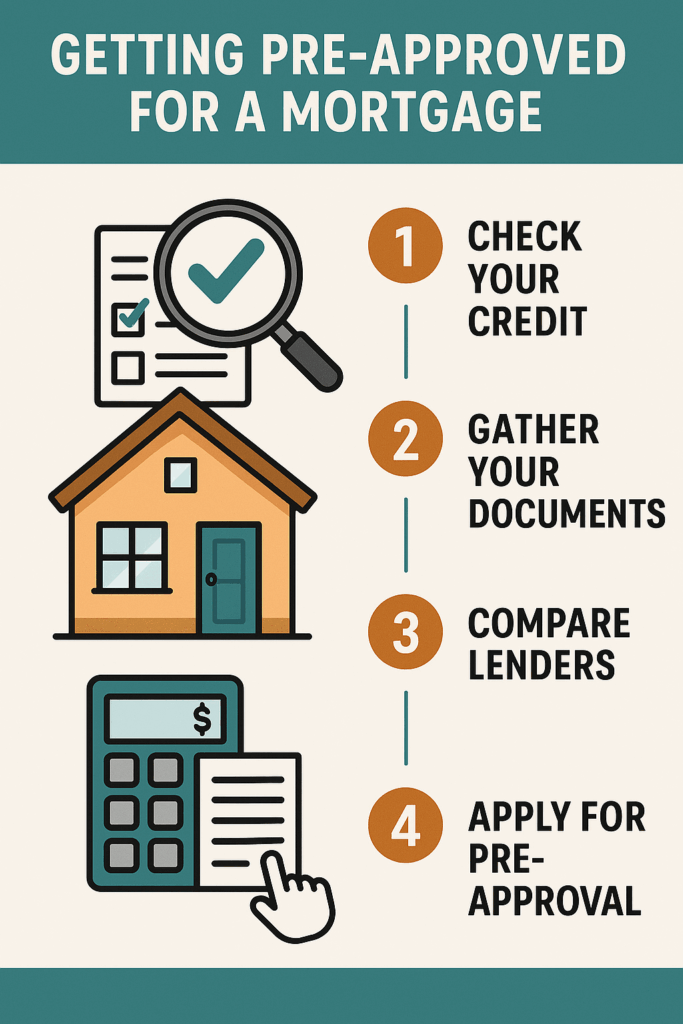

Before you tour model homes or select your dream finishes, there’s one essential step every homebuyer should take: mortgage pre-approval. At PreConstructionHomes.com, we guide you through the entire new home journey—starting with the financing process that gets you one step closer to ownership.

💡 What Is Mortgage Pre-Approval?

Mortgage pre-approval is a lender’s written estimate of how much money you’re qualified to borrow for a home. It’s based on a review of your financial documents, credit history, income, and debt. Pre-approval is not the same as final loan approval, but it’s a critical early step.

✅ Why Pre-Approval Matters When Buying New Construction

New construction communities often require proof of pre-approval before allowing buyers to:

Reserve a lot or floor plan

Sign a purchase agreement

Customize finishes in the design center

Builders want to ensure you’re financially qualified before moving forward with construction or upgrades. Pre-approval shows you’re a serious, ready-to-buy customer.

📄 What You’ll Need to Get Pre-Approved

To start the pre-approval process, you’ll typically need to submit:

Recent pay stubs (or income verification if self-employed)

W-2s or tax returns for the past 2 years

Bank statements showing assets and savings

Government-issued ID

Authorization for a credit check

Your lender will use this information to assess your creditworthiness and calculate how much home you can afford.

🔍 Pre-Approval vs. Pre-Qualification: What’s the Difference?

Pre-Qualification is a quick estimate based on self-reported information.

Pre-Approval involves document verification and a credit check, offering a much more reliable figure.

Builders and real estate professionals typically prefer pre-approval because it carries more weight in negotiations and planning.

🛠️ Choosing the Right Lender for New Construction

When buying a pre-construction home, consider using a lender with experience in:

Extended rate locks (to protect you from rising interest rates during the build)

Construction-to-permanent loan options

Builder-preferred lending programs with incentives such as closing cost credits or upgrade packages

📌 Tip: Ask the builder if they offer bonuses for using their preferred lender—it could save you thousands.

🧾 What Happens After Pre-Approval?

Once you’re pre-approved, you’ll receive a pre-approval letter that outlines:

The loan amount you’re qualified for

Estimated monthly payments

Loan type and term

Interest rate (if applicable)

Bring this letter with you when you tour model homes or speak with a sales rep. It can help you reserve a home, negotiate upgrades, or secure your preferred lot quickly.

📍 Ready to Get Pre-Approved?

Whether you’re just beginning your search or already have a new construction community in mind, getting pre-approved is the smartest way to start.

Here’s how to begin:

Choose a reputable lender or ask us for referrals to builder-preferred options

Gather your documents

Apply online or in person

Receive your pre-approval letter—usually within 1–3 days

🚀 Start Building Your Future Today

At PreConstructionHomes.com, we make it easy to find the perfect new construction home—and connect you with the tools and experts you need to make it yours. Getting pre-approved is your first step toward homeownership, and we’re here to help guide you the rest of the way.

➤ Need help finding a lender or community?

Contact us today or explore our featured listings to get started.

Need to fix your credit?

We have partnered with a top tier credit repair company to get quick results needed to get you approved.

Credit Score FAQS

Pre-approval shows builders that you’re a serious and qualified buyer. Most builders won’t let you reserve a lot, select upgrades, or sign a purchase agreement without it. It also helps you understand your budget, so you don’t waste time touring homes outside your price range.

Lenders typically ask for:

Recent pay stubs or income verification

W-2s or tax returns (last 2 years)

Bank statements and asset documentation

A valid photo ID

Authorization for a credit check

Having these ready can speed up the process significantly.

Yes, but only slightly. A mortgage pre-approval involves a hard credit inquiry, which may cause a minor, temporary dip in your credit score. However, credit scoring models allow multiple mortgage inquiries within a short time frame (typically 14–45 days) to count as one inquiry, so it won’t hurt to shop around.

Absolutely! In fact, it’s recommended. Pre-approval helps you determine what price range to shop in and gives you a competitive edge when touring communities. Once you find a home, your lender can update your pre-approval into a formal mortgage application tailored to that property.

New vs Used Homes

Mortgage Calculator