Unlocking Homeownership: How Credit Guidance Transforms Dreams into Reality

Unlocking Homeownership: How Credit Guidance Transforms Dreams into Reality

Understanding the Homebuyer Support Program

The Homebuyer Solutions Program (HSP) offers free credit guidance to potential homeowners who meet all criteria for a new home except their credit score. We spoke with Sara, a Credit Specialist, to uncover how the program works and its impact.

Who Qualifies for the Program?

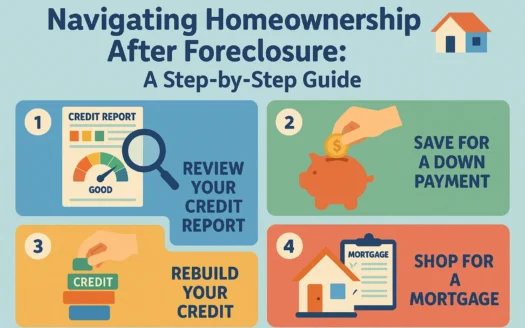

Customers are referred after a mortgage assessment and consultation with a loan officer. The program focuses on those who need to boost their credit score to finalize loan approval for their future home.

Timeline for Success

The journey varies—some improve their credit in 30 days, while others need up to 9 months. Each participant receives:

- A personalized credit improvement plan

- Regular progress updates shared with the mortgage and construction teams

- Ongoing support to align credit goals with home construction timelines

Why This Program Stands Out

Unlike standard credit solutions, this program ensures:

- Pre-qualification before enrollment

- Collaboration between credit specialists and housing teams

- A focus on long-term financial health over quick fixes

Program vs. Credit Repair Companies

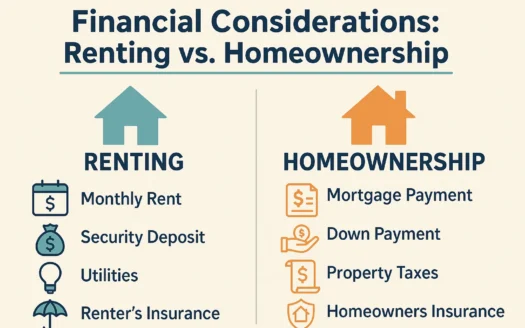

While credit repair services often charge fees for uncertain outcomes, this program emphasizes:

- Free education on credit management

- Tools for self-driven credit improvement

- Skills to maintain financial stability beyond home purchase

A Day in the Life of a Credit Specialist

Sara shares her motivation: Many clients face setbacks like medical debt or job loss. Teaching them to rebuild credit—and seeing families unlock homeownership—is incredibly rewarding.

Her work often culminates in emotional home closings where clients celebrate overcoming financial hurdles.

What Does a Credit Specialist Do?

These professionals help clients by:

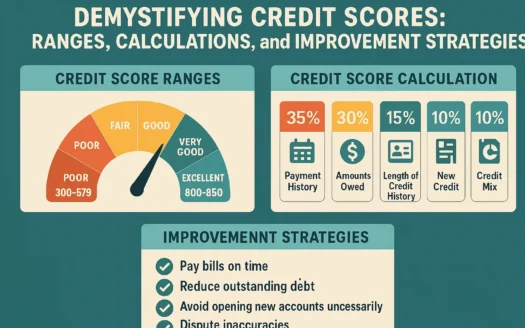

- Analyzing credit reports for improvement opportunities

- Creating step-by-step action plans

- Providing ongoing guidance for financial literacy