Understanding and Reducing Closing Costs When Buying a Home

Navigating Closing Costs: A Comprehensive Guide for Homebuyers

Buying a brand-new home is an exciting milestone, but many buyers overlook the additional upfront expenses beyond the purchase price. These costs can add up quickly, creating financial stress. Planning ahead for both your down payment and closing costs is essential to ensure a smooth homebuying journey.

Why Closing Costs Matter

Closing costs are significant, often totaling thousands of dollars. For first-time buyers, understanding these expenses is critical to avoid last-minute surprises. Whether purchasing a new construction home or an existing property, saving early for closing costs, earnest money, down payments, taxes, and insurance is key.

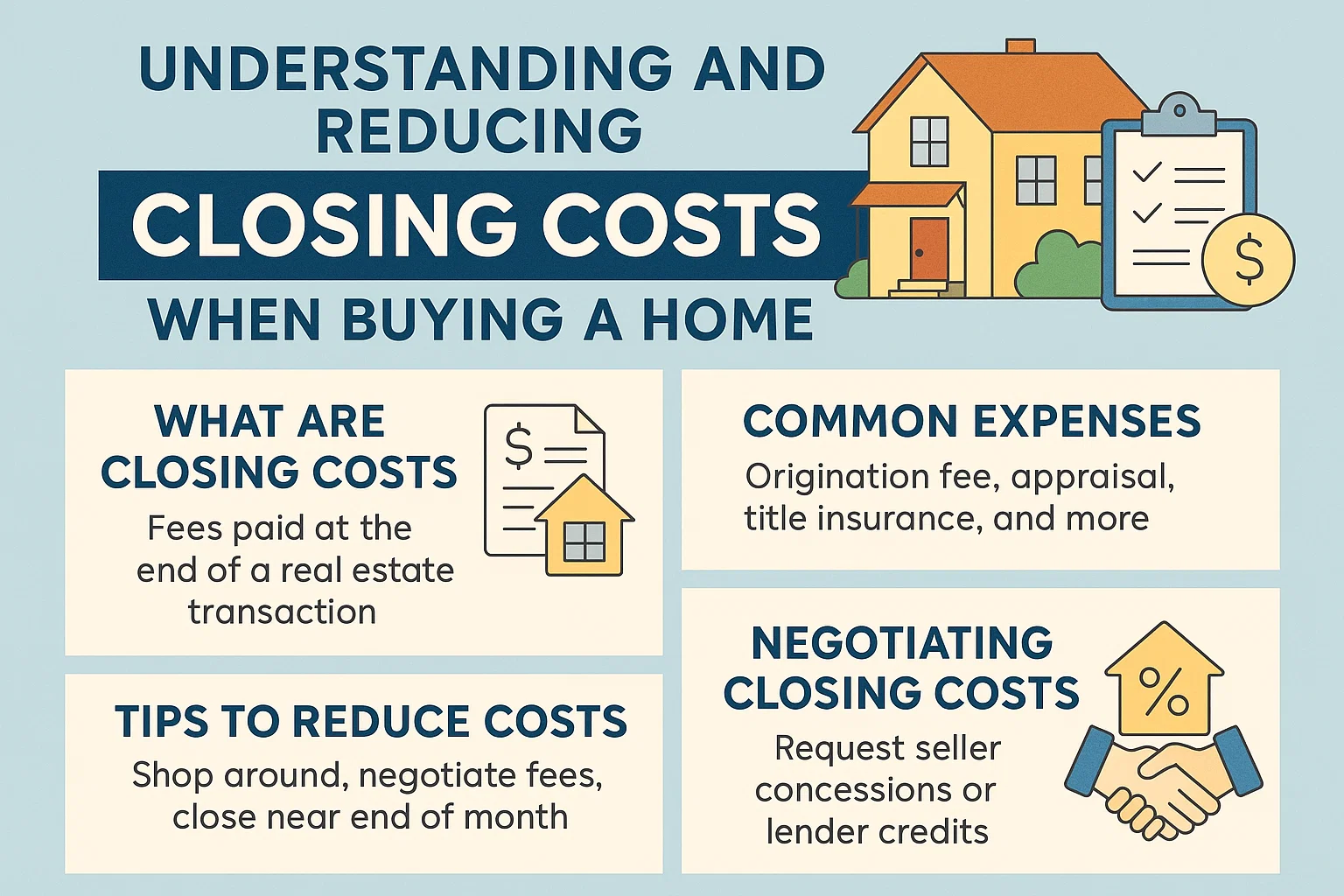

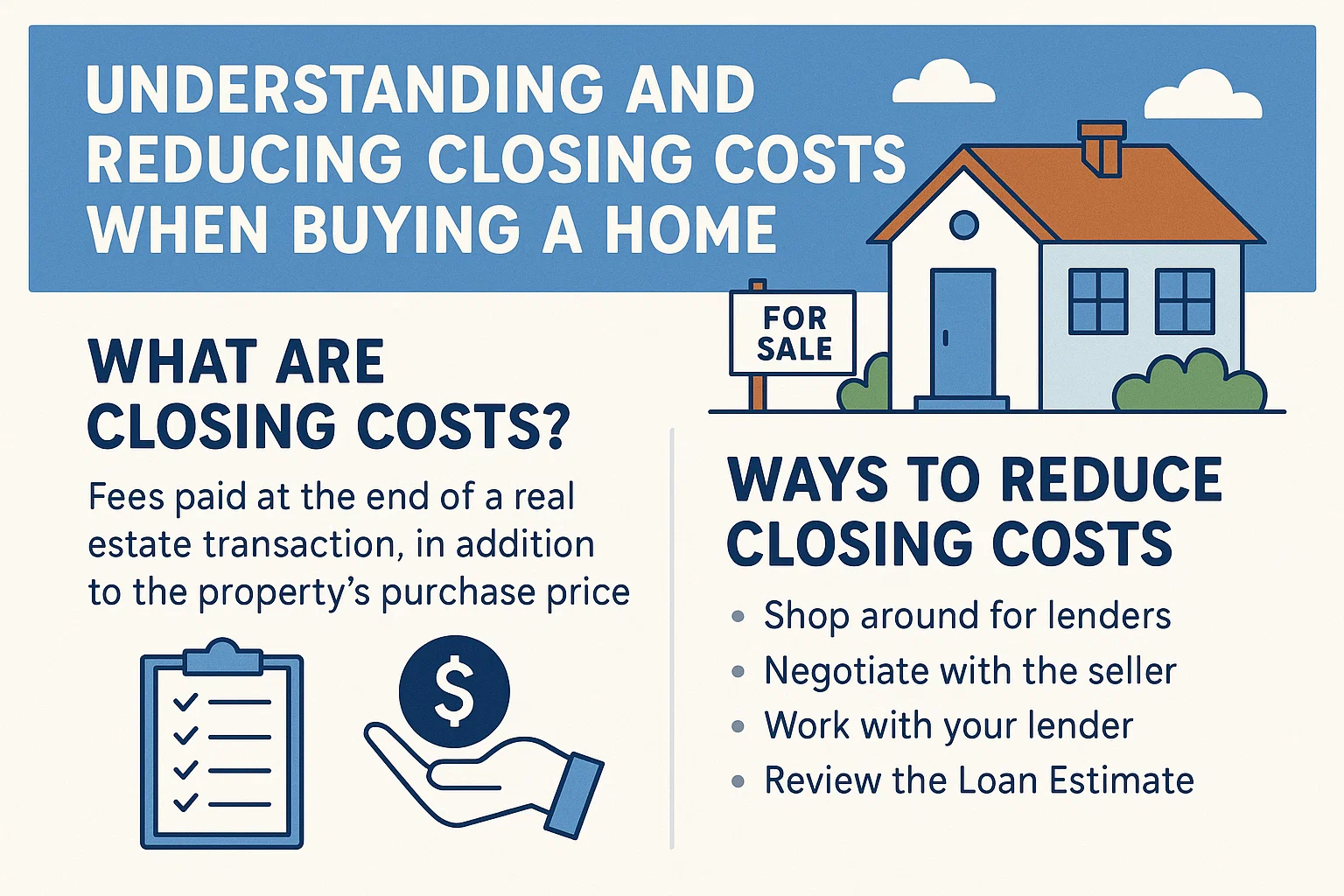

What Are Closing Costs?

Closing costs cover administrative and transactional fees required to finalize a home purchase. These include:

- Mortgage application and underwriting fees

- Home appraisal and inspection

- Title search and insurance

- Property taxes and attorney fees

How Much Should You Budget?

Closing costs typically range from 2% to 5% of the loan amount. For example, a $300,000 mortgage could incur $6,000–$15,000 in closing costs. Combined with other upfront expenses, the total can be substantial:

| Expense | Low Estimate | High Estimate |

|---|---|---|

| Earnest Money (1–5%) | $3,000 | $15,000 |

| Down Payment (6–20%) | $9,000 | $60,000 |

| Closing Costs (2–5%) | $6,000 | $15,000 |

| Prepaid Taxes + Insurance | $2,500 | $2,500 |

| Total | $15,000 | $92,500 |

Who Pays Closing Costs?

While buyers typically cover most closing costs, sellers may contribute in competitive markets. Builders of new construction homes often offer incentives to reduce or cover these expenses.

Buyer Responsibilities (2–5% of loan):

- Appraisal, inspection, and application fees

- Title search and insurance

- Prepaid taxes and insurance

Seller Responsibilities (5–6% of sale price):

- Real estate commissions

- Title insurance and concessions

Strategies to Reduce Closing Costs

- Compare Lenders: Shop around for competitive rates and fees. Review the “Services You Can Shop For” section in loan estimates.

- New Construction Incentives: Many builders partner with lenders to offer special financing options or closing cost credits.

- Negotiate with Sellers: Request contributions toward closing costs, especially in slower markets.

- Explore Assistance Programs: Grants or loans from nonprofits or local governments may help cover upfront expenses.

- Time Your Closing: Schedule near month-end to reduce prepaid interest.

Final Tips for Homebuyers

To minimize financial stress:

- Start saving early for all upfront costs.

- Ask about lender or builder incentives.

- Consider rolling closing costs into your loan if cash is tight (note: increases monthly payments).

By planning ahead and exploring cost-saving opportunities, you can streamline your path to homeownership and enjoy your new home sooner.