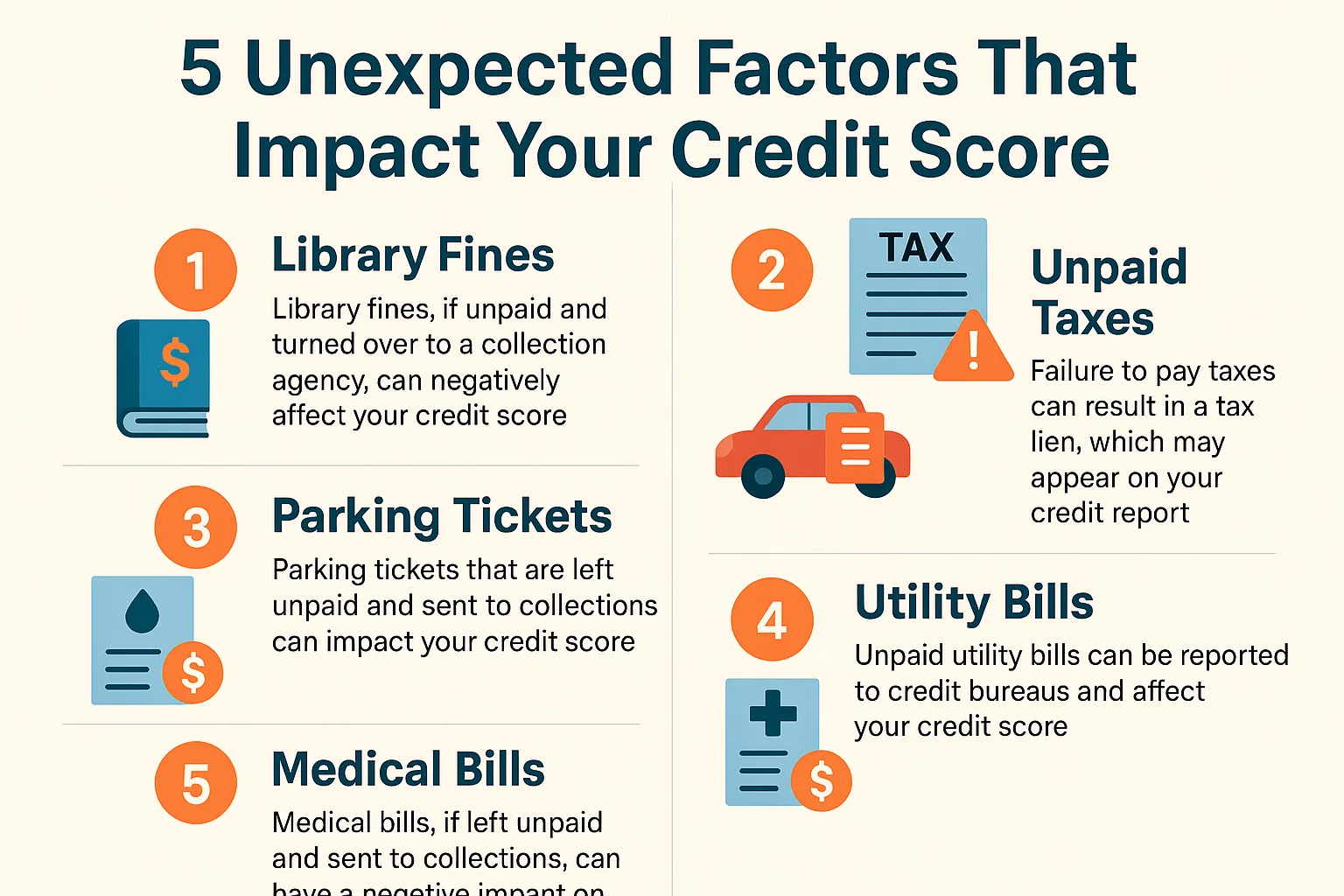

5 Unexpected Factors That Impact Your Credit Score

5 Unexpected Factors That Impact Your Credit Score

Your credit score is influenced by more than just loan payments and credit card usage. Discover some surprising factors that might be affecting your credit rating.

1. Collections

Many everyday unpaid debts can be sent to collections without you realizing it. These third-party debt collectors often report these unpaid accounts to credit bureaus, which then appear on your credit report and lower your score. Common examples include:

- Utility bills

- Library fees

- Medical bills

- Parking tickets

- Gym memberships

2. Late Tax Payments

While late or unpaid taxes don’t immediately hurt your credit score, they can cause serious damage later. If taxes remain unpaid for an extended period, the IRS may file a Notice of Federal Tax Lien against you. This notice will appear on your credit report and significantly decrease your credit score.

3. Multiple Credit Card Applications

Each time you apply for a credit card (even for store discounts), the lender performs a hard credit inquiry. These inquiries remain on your record and can accumulate, negatively affecting your credit score – regardless of whether you’re approved for the card or not.

4. Closing Credit Cards With Zero Balance

Canceling a credit card affects your score in two ways:

- Reduces your total available credit, which may increase your credit utilization ratio

- Shortens the average age of your credit history

Both factors can lead to a lower credit score, even if the card had no balance when closed.

5. High Credit Card Balances

Regularly carrying balances close to your credit limit can cost you credit score points. Financial experts recommend keeping balances below 30% of your credit limit. Exceeding this threshold begins to decrease your score, and maxing out your cards has an even greater negative impact.

Key Terms:

Hard Credit Inquiry: Occurs when you apply for credit (mortgage, credit card, auto loan, etc.). Lenders view multiple recent applications as increased risk, which may lower your score. Also called a “hard pull.”

Credit Utilization Ratio: The percentage of your total credit limit represented by your current balances. Calculated by dividing your outstanding balances by your total credit limits across all cards.