Essential Homebuying Questions Answered: Credit, Resources, and More

.png)

Essential Homebuying Questions Answered: Credit, Resources, and More

Many prospective buyers have questions about the homebuying process, especially regarding financial readiness. Below, we address common concerns and provide insights to help you navigate your journey.

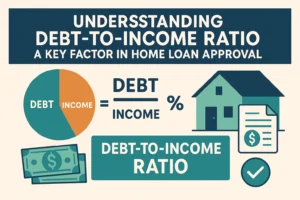

Credit and Mortgage Readiness

Q: Do I need perfect credit to buy a home?

A: No—while a strong credit history can improve your mortgage interest rates, it’s not an absolute requirement. To assess your readiness, consider exploring resources like our free First-time Homebuyer Guide, which includes:

- Budget worksheets

- Credit management strategies

- Mortgage FAQs

- Moving checklists

For credit-specific guidance, we offer dedicated resources such as:

- A guide to improving credit scores for mortgage applications

- Advice for purchasing a home after major financial setbacks (e.g., bankruptcy, foreclosure, or short sale)

Expert Support for Your Homebuying Journey

Through partnerships with trusted affiliates in mortgage, insurance, and title services, we provide answers to critical questions, such as:

- How to pre-qualify for a mortgage

- Factors affecting homeowners insurance costs

- Key steps in the homebuilding process

- The importance of title insurance

Stay Informed

Visit our blog’s FAQ section regularly for updates and new Q&A articles. Have additional questions? Our team is here to help you every step of the way.

.png)