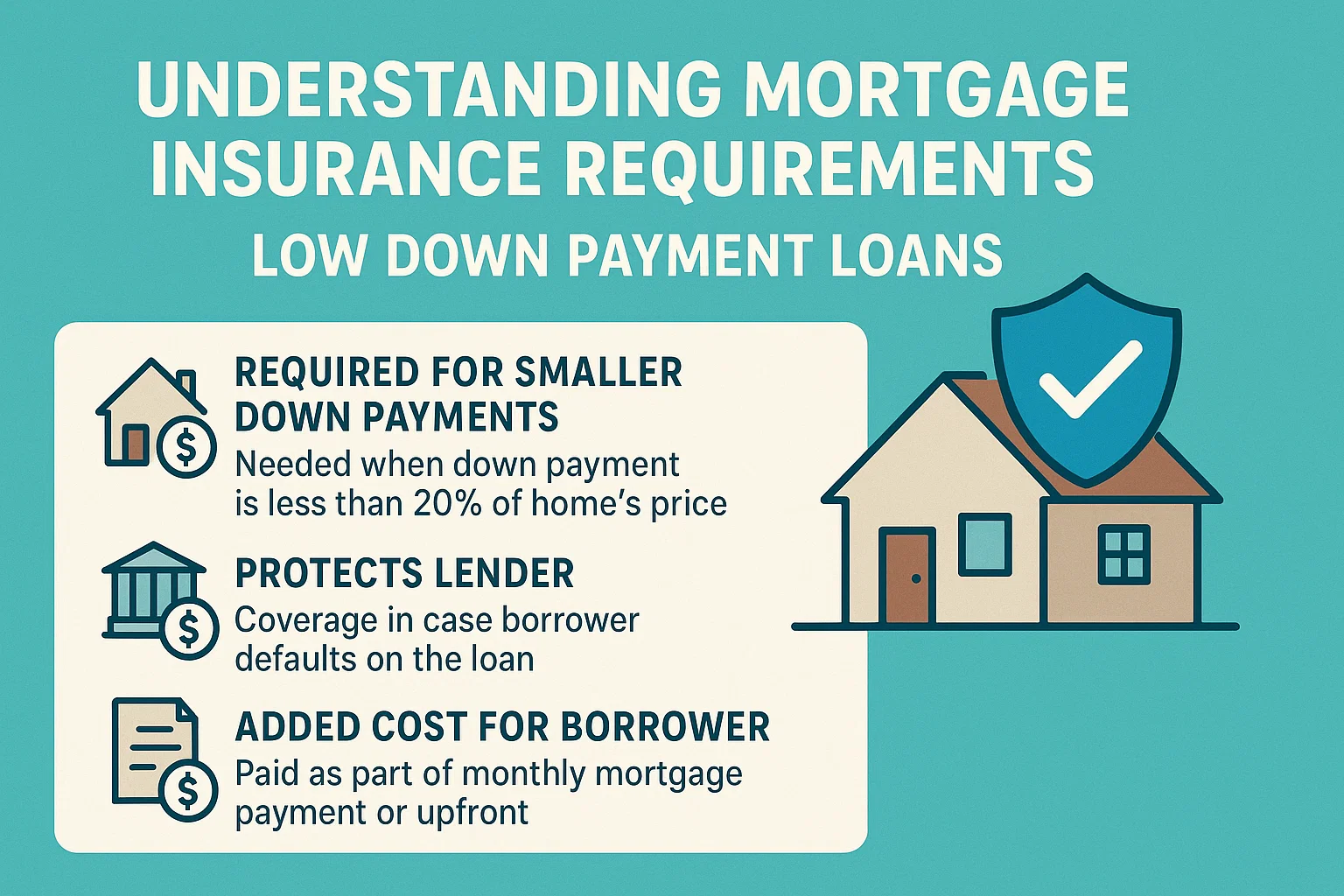

Understanding Mortgage Insurance Requirements for Low Down Payment Loans

What You Need to Know About Mortgage Insurance

Opting for a down payment of less than 20% on a home can make homeownership more accessible, but it often comes with a trade-off: mortgage insurance. This insurance reduces the lender’s risk, allowing borrowers to qualify for loans they might otherwise not secure. Depending on the loan type, mortgage insurance may be added to your monthly payment, closing costs, or both. Below is a breakdown of how different loan programs handle this requirement.

Conventional Loans

- Uses Private Mortgage Insurance (PMI) from a private provider.

- Premiums are typically added to monthly payments with minimal or no upfront closing costs.

- Rates depend on the down payment amount and the borrower’s credit score.

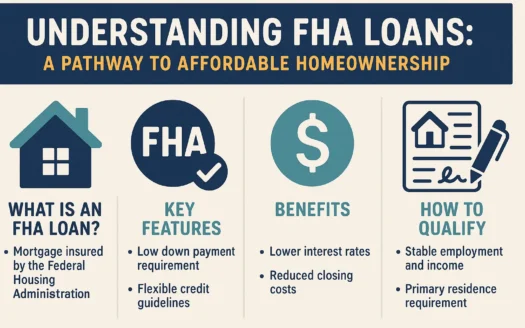

FHA Loans

- Requires a Mortgage Insurance Premium (MIP) paid to the Federal Housing Administration.

- Costs are included in both closing costs and monthly payments.

- Rates remain consistent regardless of credit score, but down payments below 5% incur slightly higher premiums.

USDA Loans

- Similar to FHA loans but often more affordable.

- Insurance costs are rolled into both closing costs and monthly payments.

VA Loans

- No monthly mortgage insurance fee due to the VA guarantee.

- Requires a one-time upfront funding fee based on military service history, down payment, and other factors.

Important Considerations

For government-backed loans (FHA, USDA, VA), borrowers can roll upfront fees into the total mortgage. While this avoids out-of-pocket expenses, it increases the loan amount and long-term costs. Always evaluate how these fees impact your financial goals before deciding.