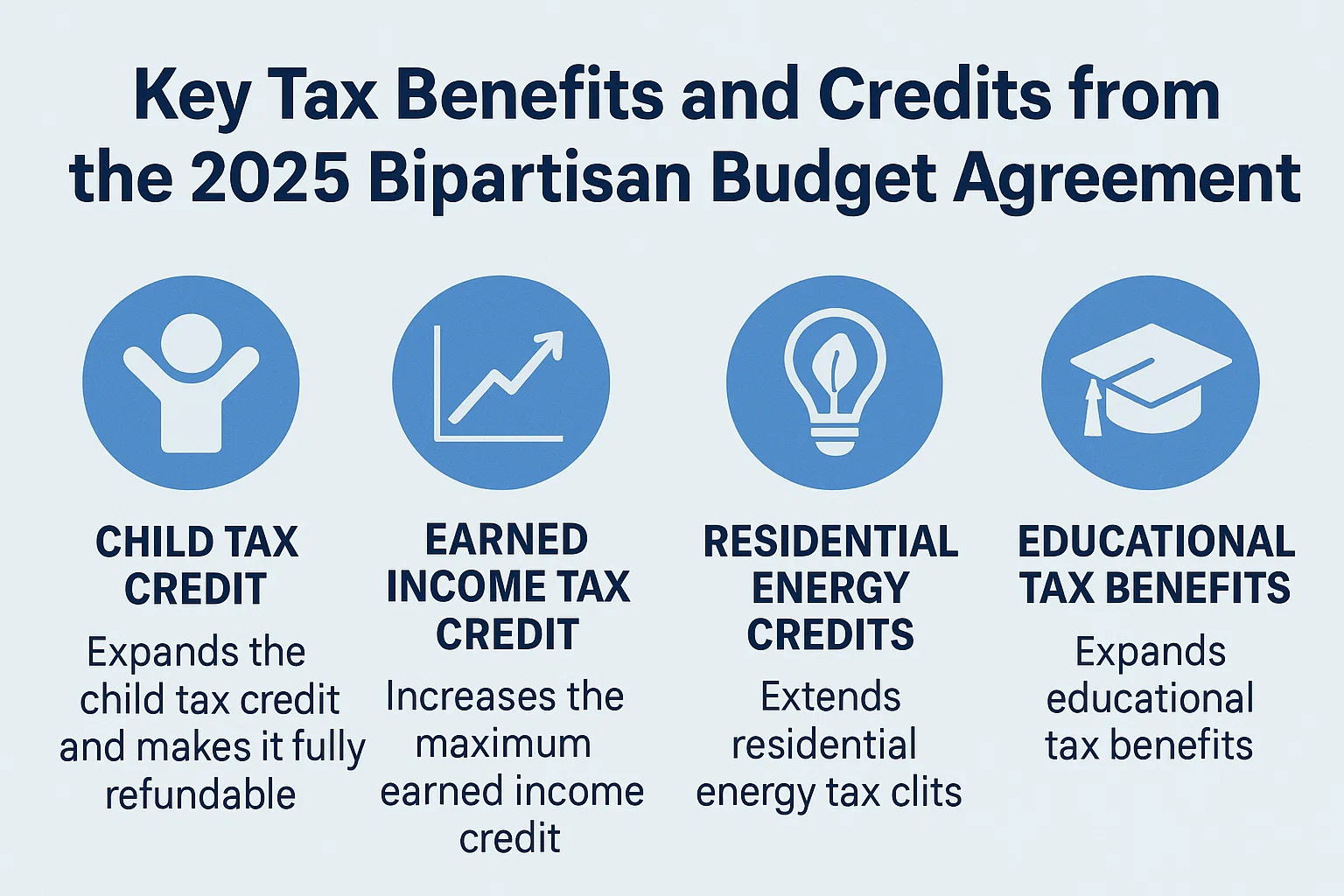

Key Tax Benefits and Credits from the 2025 Bipartisan Budget Agreement

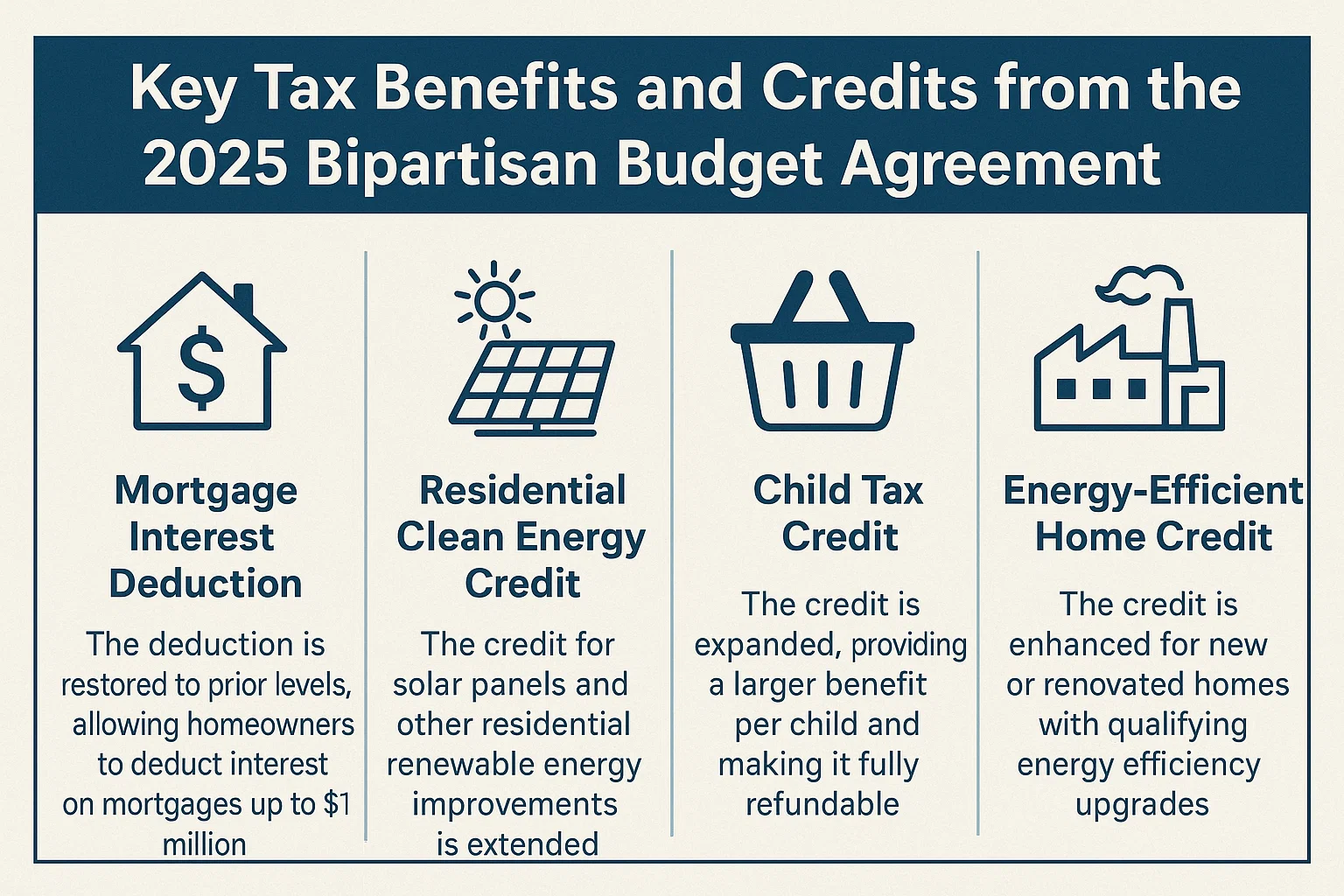

Key Tax Benefits and Credits from the 2025 Bipartisan Budget Agreement

Following a temporary government shutdown due to congressional disagreements, a bipartisan budget agreement was finalized on February 9, 2025. This legislation introduces significant tax breaks and financial benefits for individuals and businesses. Below is a breakdown of key provisions that may impact your tax filings:

Tax Breaks for Homeowners

- Debt Forgiveness Exclusion: Exclude forgiven mortgage debt on your primary residence from taxable income for 2025 filings.

- Mortgage Insurance Deduction: Deduct premiums paid for mortgage insurance, even if the policy was required due to loan default risks.

Education-Related Deductions

- Tuition and Expenses: Deduct up to $4,000 in college tuition, books, and supplies for households earning ≤$65,000 annually (≤$130,000 joint filers).

- Reduced Deduction: Claim $2,000 for households earning ≤$80,000 annually (≤$160,000 joint filers).

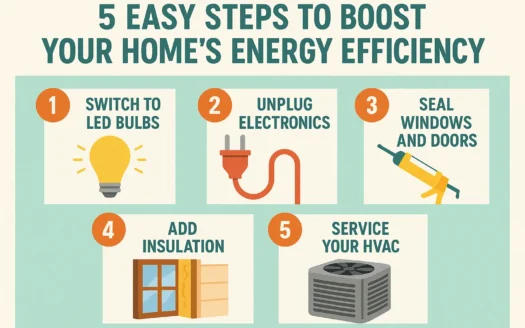

Energy Efficiency Credits

- Home Improvements: Claim a credit for 10% of costs for energy-efficient upgrades (e.g., roofs, windows, doors).

- Major Upgrades: Receive 100% reimbursement for qualifying high-efficiency systems like water heaters or A/C units (primary residences only).

- Alternative Energy: Credits apply for fuel cells, wind energy systems, and geothermal heat pumps.

Vehicle and Retirement Benefits

- Vehicle Credits: Claim up to $4,000 for fuel-efficient vehicles under 8,500 pounds; higher credits may apply for heavier models.

- Early Retirement Withdrawals: Access retirement funds early without the standard 10% penalty in certain cases.

Disaster Relief Provisions

- Charitable Donations: Temporary removal of charity contribution caps to support disaster victims.

- Business Credits: Employers in designated disaster zones (September 21–October 17, 2025) can claim 40% of wages paid to employees during hurricanes, up to $6,000 per worker.

Who Benefits Most?

- Disaster-affected individuals

- Taxpayers with recently expired or extended breaks

- Homeowners with energy-efficient upgrades

Note: This summary is for informational purposes only. Consult a tax professional for personalized advice.