How to Earn Approval for Down Payment Assistance Programs for First-Time Buyers

How to Earn Approval for Down Payment Assistance Programs for First-Time Buyers

Understanding Eligibility Requirements

As you consider purchasing a home, you may have come across down payment assistance programs that aim to assist first-time homebuyers. While many programs use the term “first-time buyer,” eligibility often extends beyond those purchasing a home for the first time.

Key Definitions of a First-Time Homebuyer

- Freddie Mac’s Home Possible Program: Defines a first-time homebuyer as someone who had no ownership interest in a residential property during the three-year period preceding the purchase.

- Fannie Mae’s 97% LTV Options: Requires buyers to have had no ownership interest in a residential property during the three-year period prior to purchase.

- U.S. Department of Housing and Urban Development (HUD): Defines a first-time buyer as someone with no ownership in a principal residence three years prior to closing.

Exceptions for Displaced Homemakers

Individuals classified as displaced homemakers may also qualify for first-time buyer programs if they meet the following criteria:

- Provided unpaid services to family members (e.g., stay-at-home parent).

- Were financially dependent on another family member but no longer receive that support.

- Are unemployed, underemployed, or facing challenges securing higher-paying work.

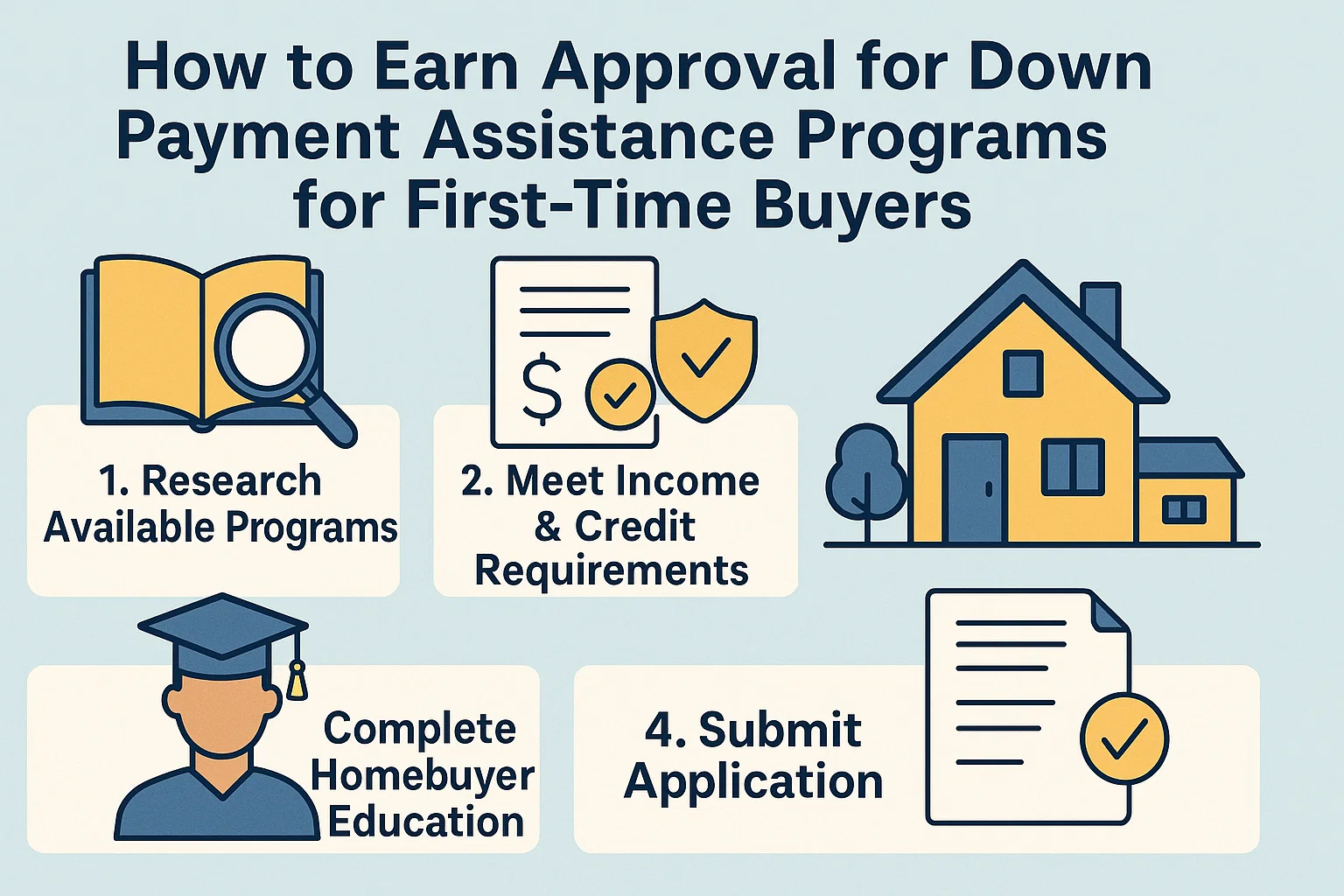

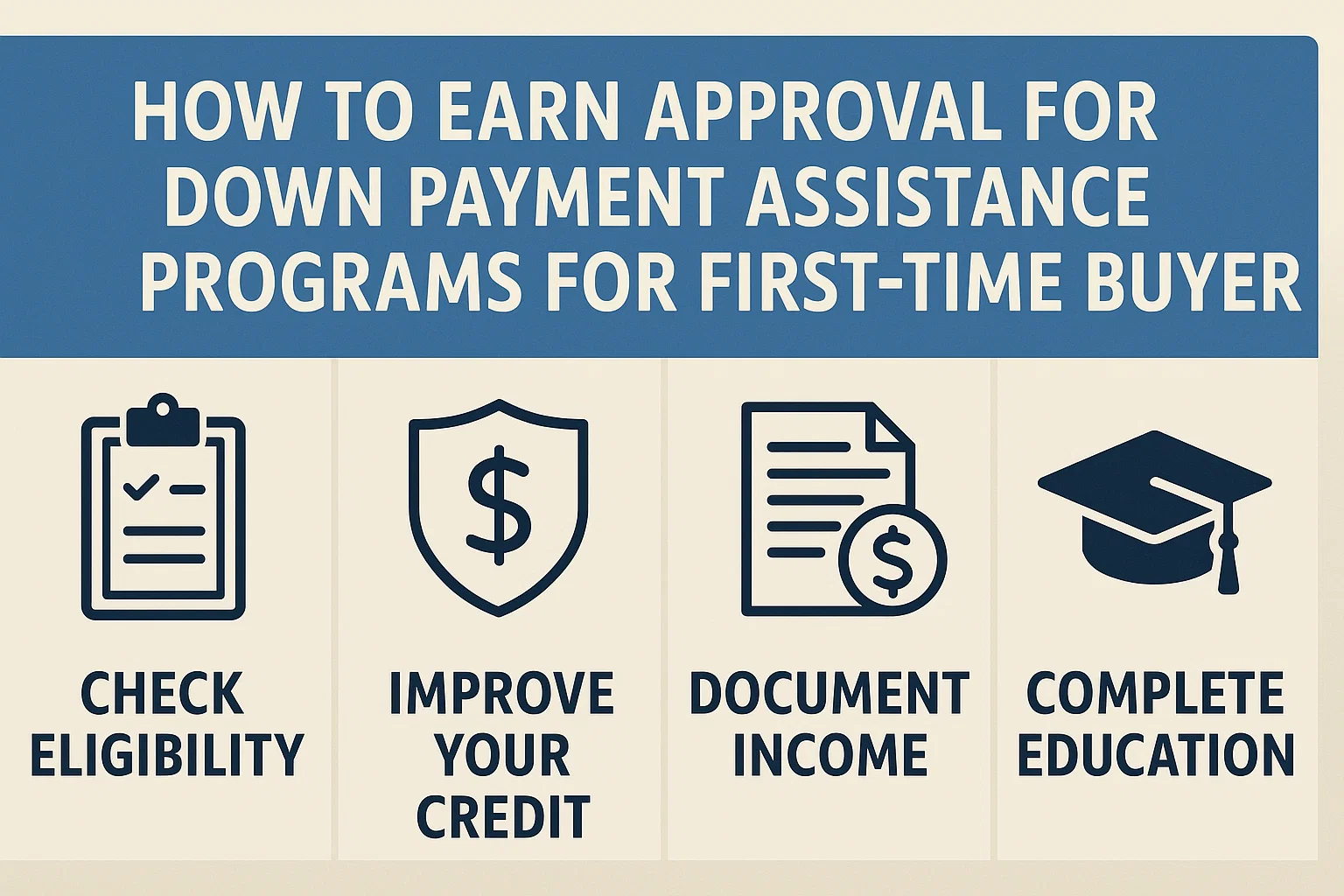

Steps to Qualify for Down Payment Assistance

1. Examine Your Debt-to-Income (DTI) Ratio

Most assistance programs enforce stricter DTI ratios than conventional lenders to reduce foreclosure risk. A typical ratio is 32/41:

- 32%: Housing-related debt (mortgage, taxes, insurance, HOA fees).

- 41%: Total recurring debt (car loans, credit cards, etc.).

2. Check Your Net Income

Many programs target low- to moderate-income families, typically those earning ≤80% of the area median income (AMI). While lenders often use gross income, budgeting with net income (after taxes and deductions) provides a clearer picture of affordability.

3. Obtain Your Credit Score

A credit score of 620 or higher is generally required for favorable rates, though some lenders accept scores as low as 580. Timely payments and low debt levels improve approval odds.

Seek Professional Guidance

Government-recognized housing counselors offer free or low-cost education on homebuying processes. For a list of HUD-approved agencies, visit hud.gov.