Debunking 5 Common Mortgage Myths Every Homebuyer Should Know

Debunking 5 Common Mortgage Myths Every Homebuyer Should Know

When navigating the homebuying process, misinformation can lead to costly decisions. Let’s dismantle common mortgage myths and reveal the facts to help you make informed choices.

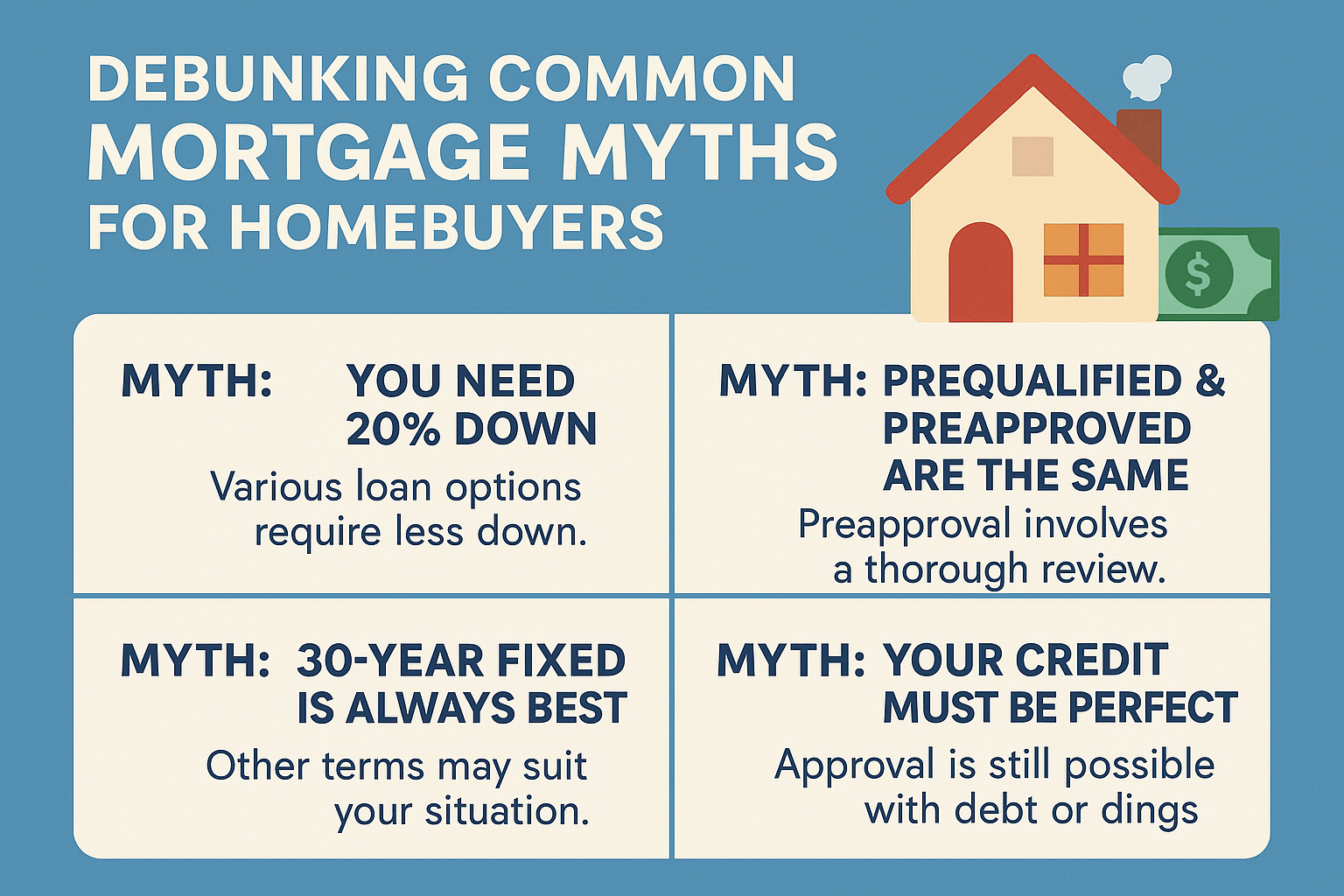

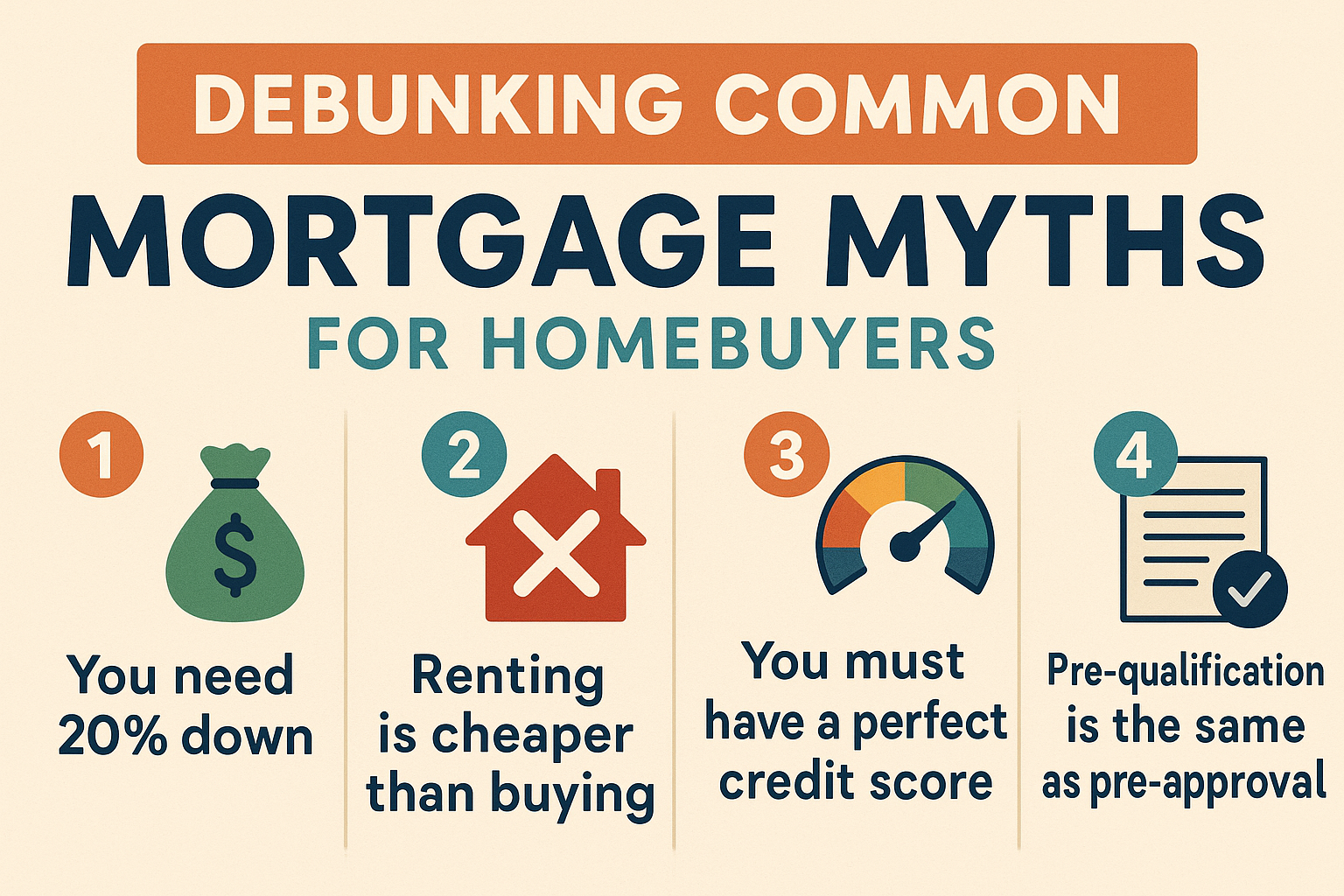

Myth #1: You Must Have a 20% Down Payment

Fact: Many borrowers can qualify for loans with as little as 3–3.5% down. VA loans may even require $0 down. Programs like FHA and conventional loans offer flexibility, though mortgage insurance may apply for down payments below 20%.

Note: Always calculate mortgage insurance costs into your budget if your down payment is less than 20%.

Myth #2: It’s Best to Pay Off Your Mortgage ASAP

Fact: While eliminating debt feels rewarding, a low-interest mortgage could free up cash for higher-return investments. Consult a financial advisor to compare paying off your mortgage versus investing surplus funds.

Myth #3: Always Opt for a 30-Year Fixed-Rate Mortgage

Fact:

- A 30-year term works for long-term homeowners, but shorter terms (e.g., 15 years) often have lower rates.

- Adjustable-rate mortgages (ARMs) may save money if you plan to move within 5–10 years.

Use a mortgage calculator to compare scenarios and monthly costs.

Myth #4: You Need a Near-Perfect Credit Score

Fact: Mid-level credit scores can still qualify for mortgages. Lenders consider steady income, on-time payments, and low debt-to-income ratios. A larger down payment may also offset credit challenges.

Myth #5: Preapproval Guarantees a Loan

Fact: Preapproval is conditional. Final approval depends on updated credit checks, income verification, and avoiding new debts (e.g., car loans or credit cards) before closing.

Final Thoughts

Mortgage decisions should align with your financial goals and circumstances. Research thoroughly, use online tools, and discuss options with a trusted loan officer to separate myth from reality.