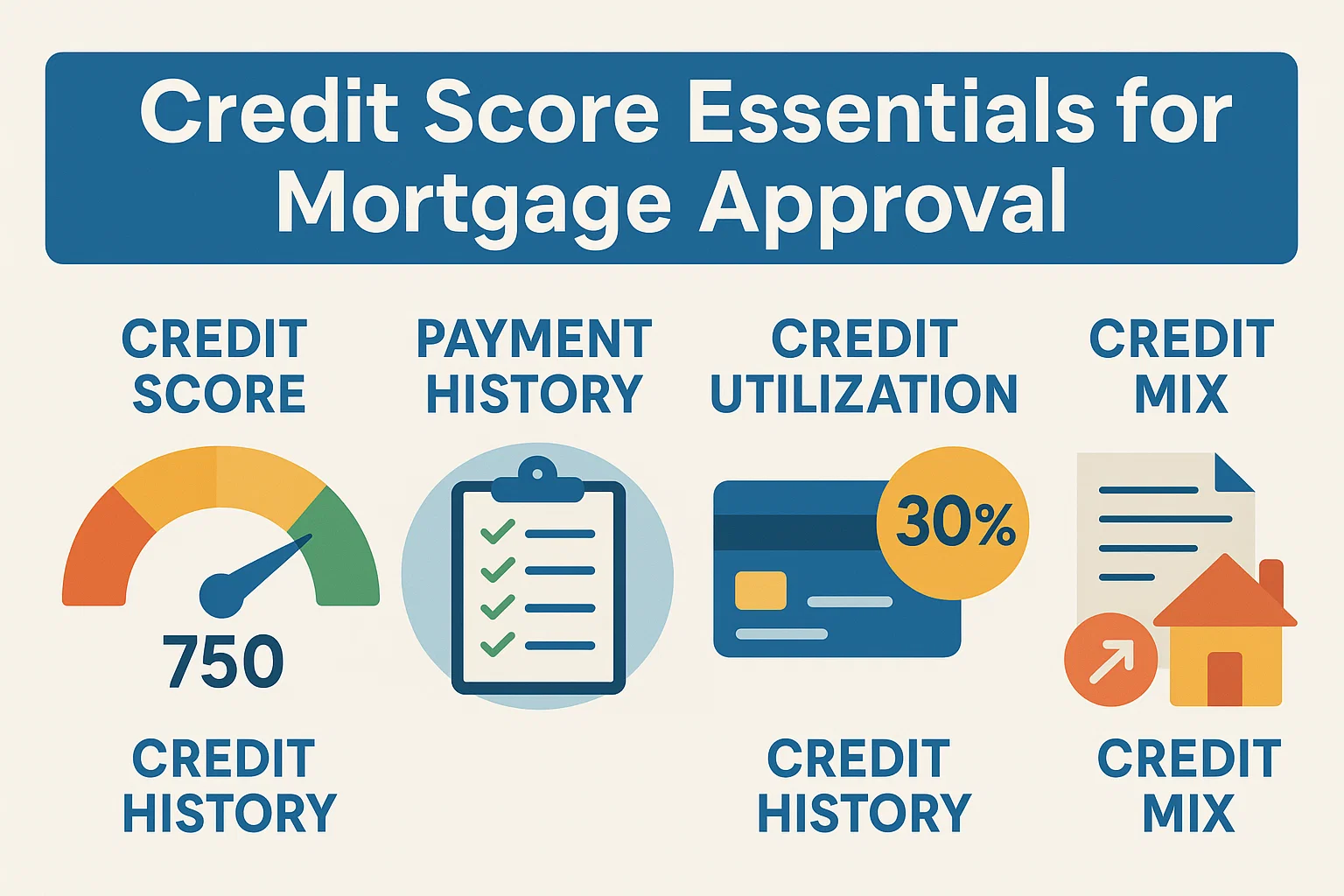

Credit Score Essentials for Mortgage Approval

Understanding Credit Score Requirements for a Mortgage

Your credit score, commonly referred to as a FICO® score, plays a pivotal role in determining your eligibility for a mortgage. Lenders use this score to assess risk and set interest rates, making it a critical factor in the homebuying process.

Why Your Credit Score Matters

While there’s no universal credit score threshold for all mortgage lenders, certain loan types have baseline requirements. Your score not only influences approval odds but also impacts the terms and rates offered by lenders.

FHA Loan Credit Score Guidelines

For government-backed FHA loans, a minimum credit score of 580 is required to qualify for the lowest down payment option (3.5% of the purchase price). However, since private lenders fund these loans, they may impose stricter criteria:

- Lenders can set higher minimum scores than the FHA’s 580 baseline.

- Some may approve scores below 580 with a larger down payment, depending on your overall credit history.

Conventional Loan Credit Expectations

Conventional loans typically demand higher credit scores compared to FHA options. Most lenders require a minimum score of 620 for approval, though this can vary based on market conditions and individual lender policies.

Preparing Your Credit for Mortgage Success

To boost your mortgage readiness:

- Monitor credit reports for errors and dispute inaccuracies

- Maintain low credit card balances

- Avoid new credit applications before homebuying

- Pay all bills consistently on time

- Keep older accounts open to preserve credit history

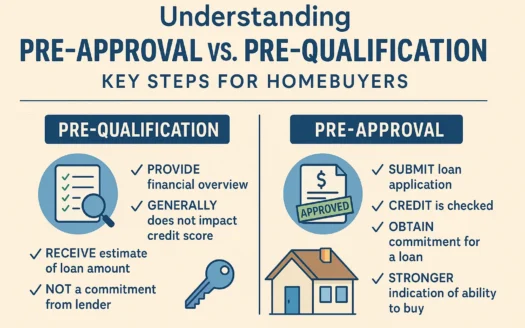

Proactively managing your credit health can improve your chances of securing favorable mortgage terms. Consider reviewing your financial profile before applying for pre-qualification.