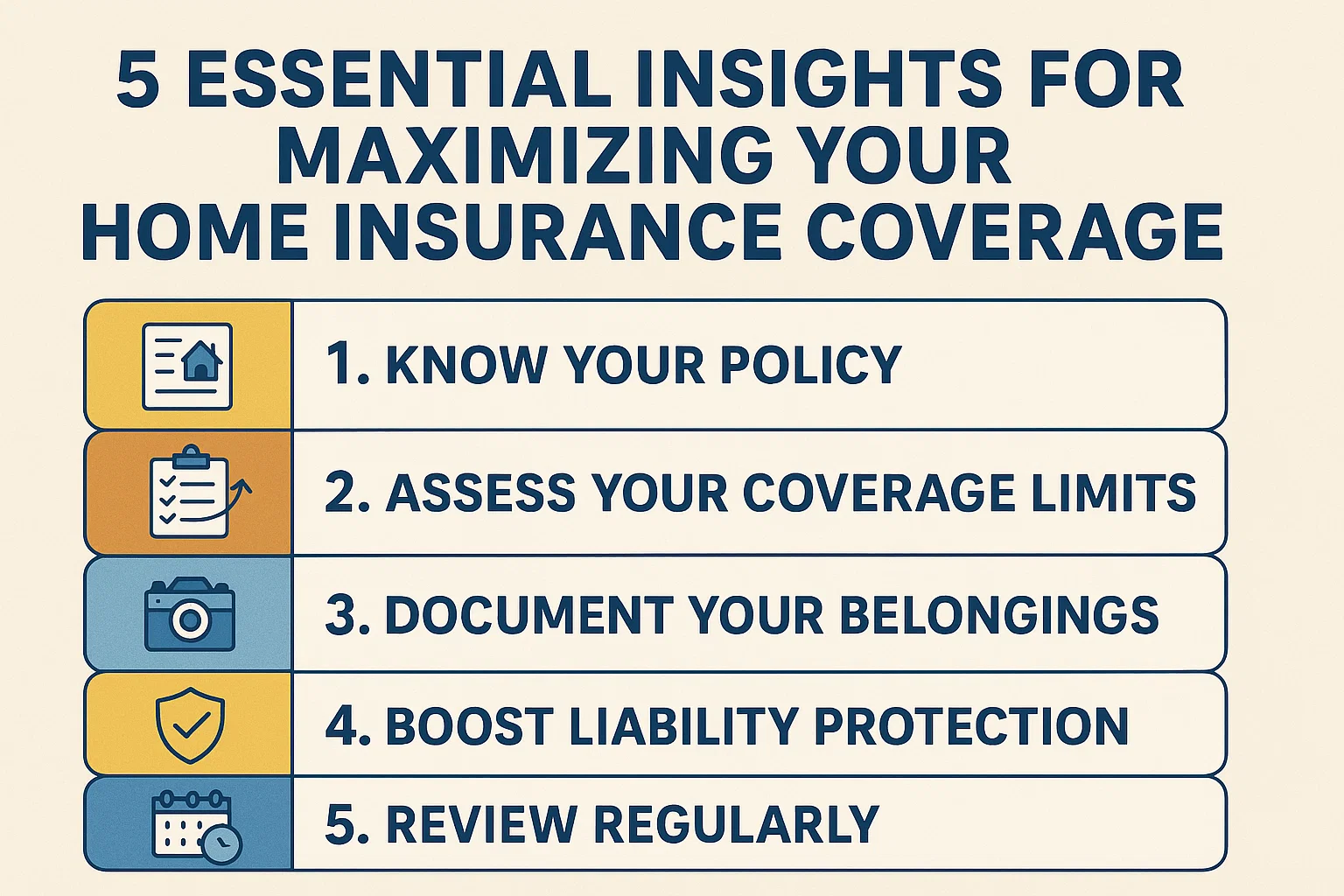

5 Essential Insights for Maximizing Your Home Insurance Coverage

5 Essential Insights for Maximizing Your Home Insurance Coverage

While the excitement of purchasing a new home is unmatched, protecting your investment from unexpected damage is critical. Homeownership comes with risks, and understanding your insurance policy is key to avoiding financial setbacks. Below are five crucial factors to ensure your coverage aligns with your needs:

1. Review Policy Exclusions

Most standard policies exclude specific risks, requiring additional coverage. Common exclusions include:

- Floods

- Earthquakes

- Power surges

- Collapse due to ice or snow

- Demolition to meet updated building codes

Always discuss add-ons with your insurer to fill gaps in protection.

2. Understand Claim Limits

Policies often cap payouts for stolen or damaged items. High-value possessions like these may need separate riders:

- Jewelry, watches, and furs

- Electronics and instruments

- Fine art and sporting equipment

- Personal records (passports, deeds, etc.)

Check your policy’s declarations page to confirm reimbursement percentages and maximum payouts.

3. Replacement Cost vs. Market Value

Replacement cost covers rebuilding your home to its original state, even if construction expenses rise. However, your payout cannot exceed your policy’s coverage limit. For example, if your home is insured for $150,000 but costs $180,000 to rebuild, you’ll only receive $150,000. Ensure your coverage reflects current rebuilding costs.

4. Actual Cash Value Payouts

Unlike replacement cost, actual cash value factors in depreciation. This means older items are reimbursed at their current market value, which may leave you undercompensated. Always verify which valuation method your policy uses.

5. Liability Coverage Limits

Homeowner’s insurance typically covers medical or legal costs if someone is injured on your property. However, policies have liability caps. Review these limits to ensure they protect your assets adequately in case of lawsuits or significant claims.

Final Tips

- Regularly update your policy to reflect home improvements or new purchases.

- Clarify what qualifies as a “sudden and accidental loss” versus negligence.

- Compare policies to secure sufficient coverage for high-risk scenarios.

By proactively addressing these areas, you’ll safeguard your home and finances against unforeseen events. Review your policy details today to avoid surprises tomorrow.