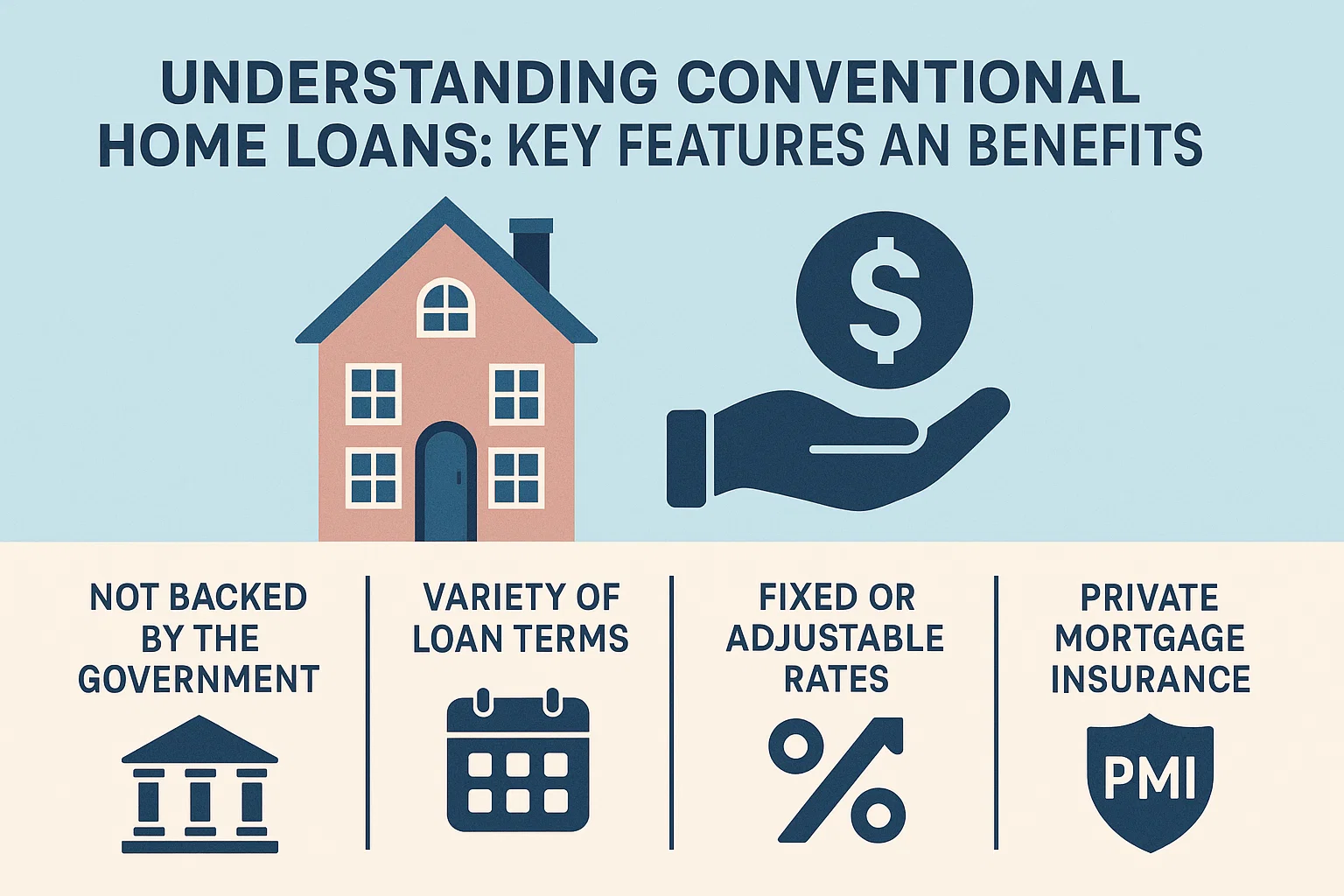

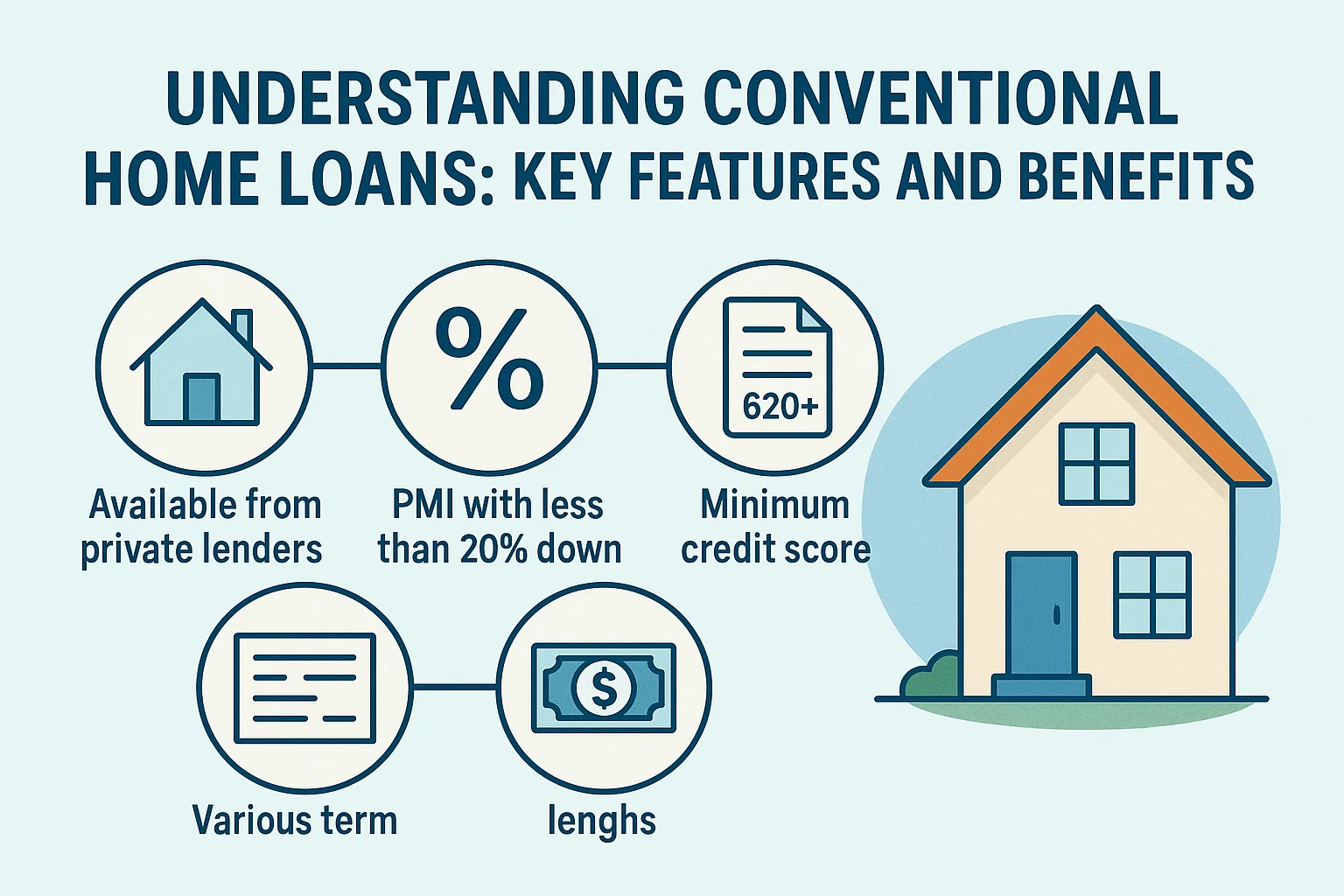

Understanding Conventional Home Loans: Key Features and Benefits

Understanding Conventional Home Loans: Key Features and Benefits

What Is a Conventional Home Loan?

A conventional home loan is a mortgage backed by private entities that standardize lending practices across the industry. These loans adhere to specific guidelines, ensuring consistency in terms and eligibility criteria. Borrowers often benefit from competitive interest rates and flexible qualification requirements, making conventional loans a popular choice for many homebuyers.

Why Choose a Conventional Loan?

Down Payment Flexibility

Conventional loans require as little as 3% down, making homeownership accessible to buyers with limited savings. However, if the down payment is less than 20%, borrowers must purchase Private Mortgage Insurance (PMI). This insurance protects the lender but can be canceled once the homeowner reaches 20% equity in the property.

Loan Limits and Applicability

As of 2025, the maximum loan limit for single-unit properties is $510,400 (or $765,600 in high-cost areas). These loans can be used for:

- Primary residences

- Second homes

- Investment properties

Financial Advantages

- Available as fixed-rate or adjustable-rate mortgages (ARMs)

- No monthly mortgage insurance with a 20% down payment

- Lower mortgage insurance costs compared to FHA loans

- Multiple loan term options to suit financial goals

Eligibility Requirements

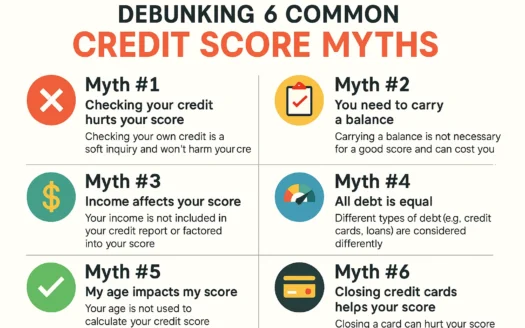

Conventional loans are ideal for borrowers with good credit scores (typically 620–640 or higher) and a debt-to-income ratio below 45%. While exceptions may exist for lower scores, such cases often involve higher borrowing costs. Prospective buyers should consult a loan officer to explore options tailored to their financial situation.

Is a Conventional Loan Right for You?

This loan type is best suited for those with stable finances and a solid credit history. If a conventional loan doesn’t align with your needs, other mortgage programs may provide alternative pathways to homeownership. Start your journey by discussing your goals with a qualified lending professional.